India is hurtling towards an electric future. With EV sales soaring—over 50,000 units sold between April and September 2023, up 112% year-on-year—there’s no denying that the country is embracing cleaner mobility. The government has set its sights on 30% EV penetration by 2030. But ambition alone is not enough. A fundamental question looms large: Is India’s infrastructure equipped to support this transition? The honest answer is—not yet.

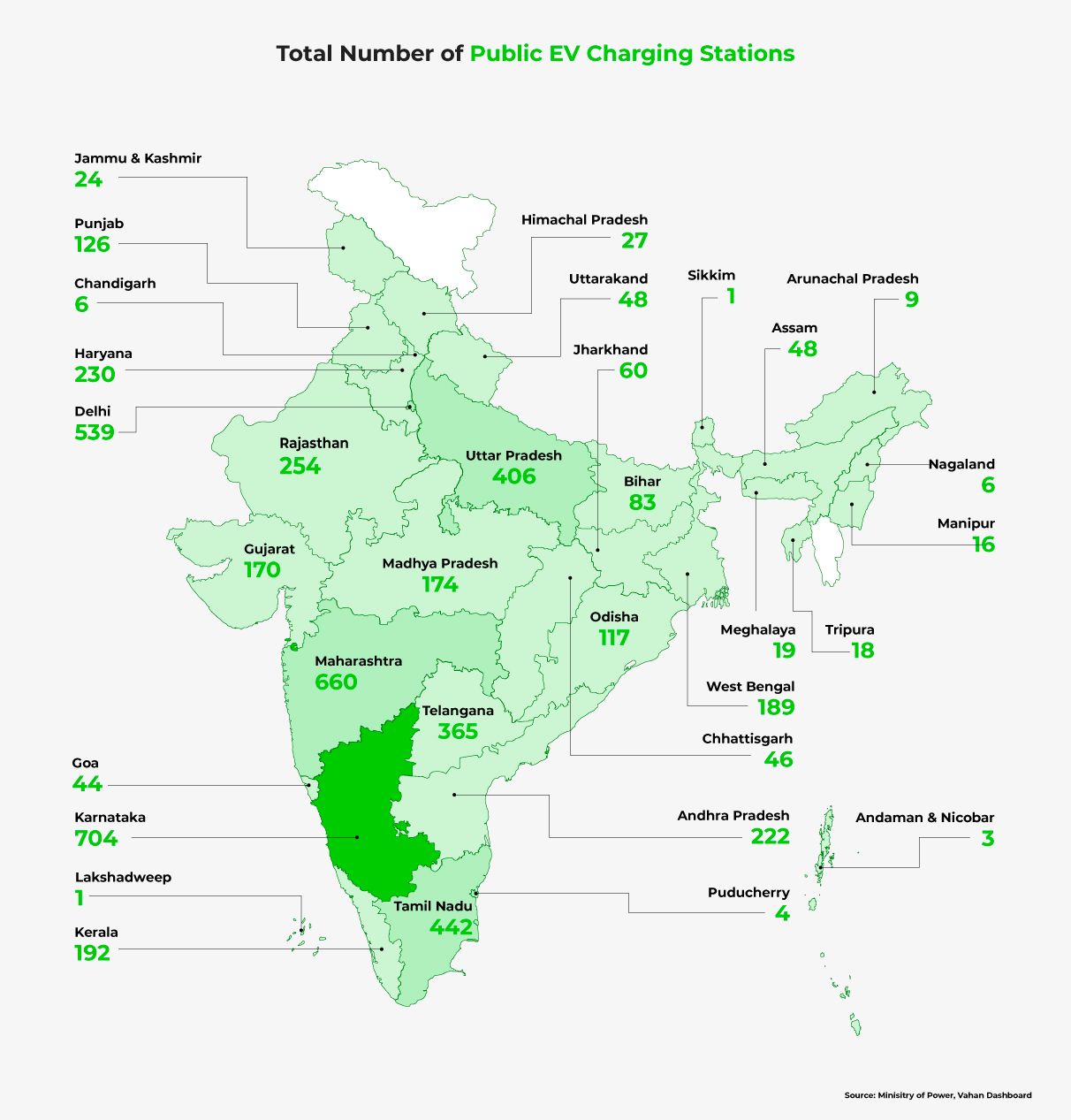

The primary bottleneck is painfully obvious: the lack of public charging infrastructure. As of March 2023, India had only 6,586 public charging stations, a laughable number given the scale of adoption projected. Delhi leads with 1,845 stations, followed by Maharashtra and Uttar Pradesh, but the national picture is patchy and urban-centric. The Confederation of Indian Industry estimates India will require 1.32 million charging stations by 2030—an annual target of over 400,000 new installations. At the current pace, this is a pipe dream. Without a reliable, accessible charging network, the EV push risks running out of charge before it ever takes off. Industry leaders echo this urgency. Sohinder Singh Gill of Hero Electric calls the charging deficit a potential deal-breaker for mass adoption, while Hyundai’s Puneet Anand points to other systemic issues: battery manufacturing, model diversity, and policy clarity. India’s EV revolution is not a sprint; it’s a marathon. But right now, we haven’t even tied our shoelaces.

Battery recycling is another critical area where India must catch up. EV batteries have a finite life span—typically 10–15 years—and improper disposal could spell environmental disaster. Toxic metals like lithium, cobalt, and nickel, if not recycled properly, will end up in landfills or pollute soil and water. Encouragingly, the battery recycling market in India is projected to grow from 2 GWh in 2023 to a staggering 128 GWh by 2030. Companies like Tata Chemicals, Log9, and Attero Recycling are taking the lead, but they need regulatory support and scale. The government’s 2022 Battery Waste Management Rules were a step forward, and schemes like EPCG and MEIS provide incentives. However, enforcement and monitoring remain weak. Meanwhile, other nations like the EU have mandated manufacturer responsibility, and automakers like Volkswagen and Renault have already set up dedicated recycling plants. India needs to follow suit, not just with policy, but with teeth.

Then there’s the lithium conundrum. For a country betting big on EVs, India has until recently lacked any meaningful domestic lithium reserves. Lithium imports—from Australia and South America—have kept prices high. The discovery of 5.9 million tonnes of lithium in Jammu & Kashmir, and more in Karnataka and Jharkhand, could change the game. But without processing and refining capabilities, these discoveries are just shiny rocks. Currently, India lacks the advanced technology to convert raw lithium into battery-grade material. Industry voices like Log9’s Pankaj Sharma warn that simply discovering lithium isn’t enough; we need material science companies, skilled professionals, and processing infrastructure. The gap between discovery and deployment could take years to bridge.

India’s EV transition is being driven by demand and policy ambition, but dragged down by infrastructural and logistical deficits. Charging stations, battery recycling, domestic lithium processing—these are the three pillars of a viable EV ecosystem. Right now, all three are underdeveloped. If India truly wants to lead the global EV movement, it must look beyond sales numbers and dig deep into infrastructure. Because you can’t drive a revolution on an empty battery.

© Copyright 2025. All Rights Reserved Powered by Vygr Media.