Cedaar Textile Limited’s SME IPO has registered remarkable success, drawing 12.26× subscription on the final day of bidding, positioning itself for a promising debut on July 7, 2025. The company's roadshow was anchored by an impressive ₹9.52 crore anchor book, achieved on June 27, 2025. The full allocation of 6.8 lakh shares at the upper price band of ₹140 underscored strong institutional confidence. Major institutions—Velcoe Opportunities Fund, SB Opportunities Fund II, Shine Star Build Cap, and Saint Capital Fund—were among the prime participants.

Such a robust anchor response often signals positive sentiment and helps build credibility for the broader public issue. In Cedaar’s case, it effectively set the stage for sustained investor interest during the public subscription window.

Public Offering: Subscription Trends Across Three Days

The book-built IPO opened on June 30 and closed on July 2, targeting a fresh issue of 43.50 lakh shares priced between ₹130–₹140 per share—a total target of ₹60.90 crore.

Despite a modest Day 1 start, the grey market premium (GMP) held firm at ₹10, suggesting a potential listing price of ₹150, ~7% above the band ₹140. As of midday Day 1, overall subscription stood at approximately 11%, with retail at 6%, NIIs at 22%, and QIBs gradually entering.

By July 2, the final day, participation surged:

-

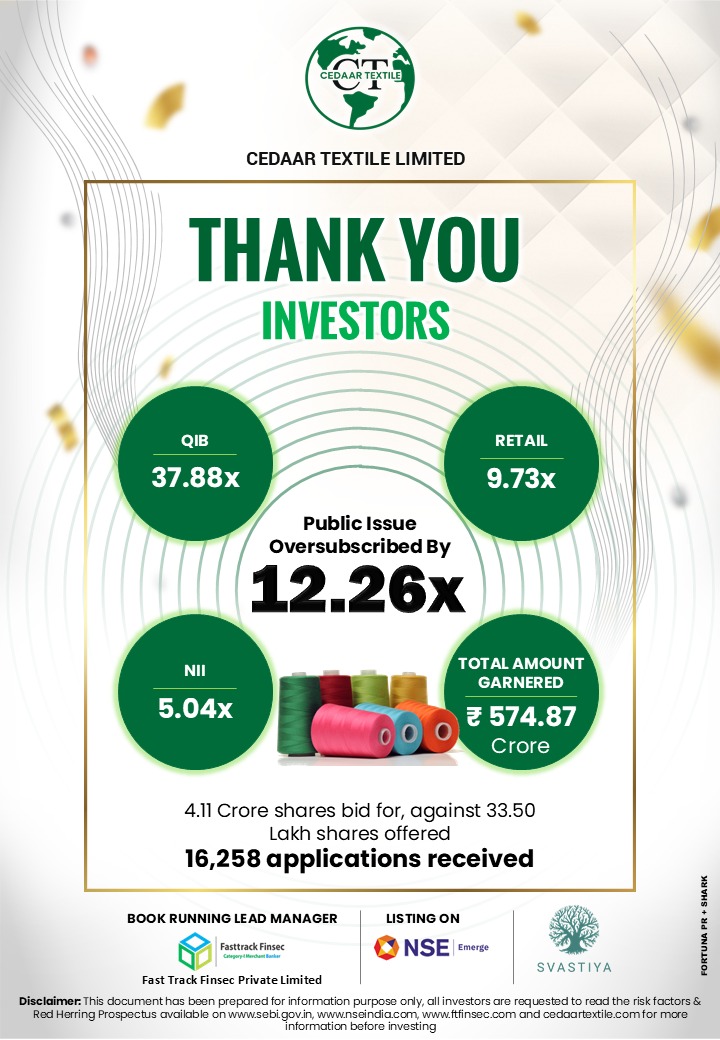

Overall: ~12.26×

-

QIBs: ~37.9×

-

Retail: ~9.7×

-

NIIs: ~5.0×

With nearly 37.9× oversubscription from QIBs, institutional confidence was further validated, while robust retail and NII interest confirmed broad market appetite.

Allotment Finalized & Credit Day Confirmed

The allotment was finalized on July 3, 2025, confirming which investors received their shares. Marching through the IPO machinery, refund and demat credit processes are underway—scheduled for July 4 via Skyline Financial Services and stock exchanges.

Use of Proceeds: Focus on Growth & ESG

Cedaar Textile plans to deploy the IPO proceeds judiciously:

-

₹8 crore for rooftop solar PV setup (captive power), aligning with sustainability goals

-

₹17 crore for modernization of manufacturing operations

-

₹24.9 crore allocated to working capital needs.

-

Remaining funds to support general corporate growth and IPO-related expenses.

This capital allocation underscores Cedaar’s drive for efficiency, cost optimisation, and ESG-friendly initiatives, especially in renewable energy.

The Business Backbone: Product, Revenues, Sustainability

Founded in September 2020, Cedaar specializes in value‑added yarns, offering melange, top‑dyed, and fancy yarn variants across fiber types (cotton, polyester, viscose, acrylic, Tencel, modal, etc.) . With integrated raw material procurement and production spanning 583 employees (as of June 2025), the company caters to both domestic and international brands.

Financially, for FY24 (ended March 31, 2024), revenues were ₹191.01 crore, and PAT reached ₹11.05 crore—a notable jump from ₹4.59 crore in FY23. Revenue grew ~17% year-over-year, with profit more than doubling—testifying to strong operational performance and profitability.

Moreover, Cedaar places sustainability at its core, focusing on 100% organic and recycled fibers, reinforcing its green credentials.

What Investors Should Expect Next

July 4: Demat credits and refunds begin. Check Skyline registrar, NSE/BSE, or your demat accounts for status.

July 7: Listing on both NSE SME and BSE SME—watch for debut trading activity and price moves.

Market Reaction: Given historical IPO behavior, expect a strong listing bounce, likely near ₹150. Further performance will depend on broader market sentiment, textile industry trends, crude/fiber prices, and execution of modernization/renewable initiatives.

With inputs from agencies

Image Source: Multiple agencies

© Copyright 2025. All Rights Reserved Powered by Vygr Media.