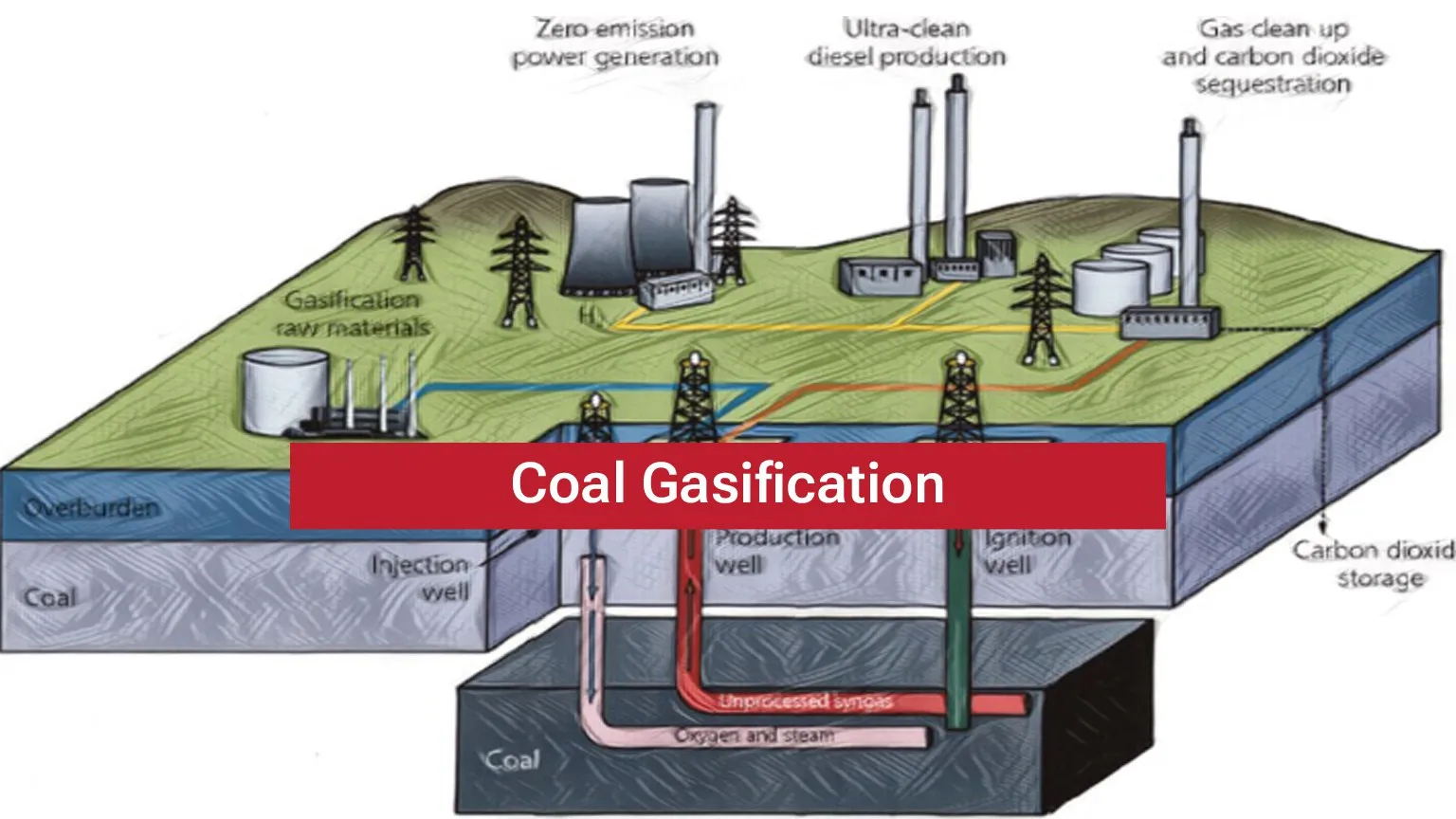

Over the last decade, India has increasingly doubled down on coal as core to its energy security. The Government launched a National Coal Gasification Mission with an explicit target to gasify 100 million tonnes (MT) of coal by 2030. India’s domestic coal production crossed ~1.04 billion tonnes in 2024–25 (provisional), underlining the strategic rationale to add value to domestic coal via gasification. But coal gasification — converting coal into syngas, methanol, ammonia, or hydrogen — has long been talked about as an alternative to burning coal outright.

In January 2024 the Centre approved an ₹8,500 crore financial-incentive (VGF-style) package to promote coal/lignite gasification projects across PSUs and the private sector. Of the ₹8,500 crore package, about ₹6,100 crore has been allocated and a second tranche for the remainder was reported for rollout in 2025. Recently, the government has moved from talk to action: roadshows, auctions, and incentives.

The question is: given the last ten years of experience, what realities are being ignored in the rush? And will this strategy succeed, or leave India stuck in a costly, polluting legacy?

The Past 10 Years: Trends & Failures

To understand whether coal gasification is India’s next frontier or its next folly, it helps to look back at what has already played out.

-

Coal Remains the Backbone, but Pressure Mounts

-

As of FY 2022-23, coal supplied nearly 79% of domestically produced energy.

-

Coal & lignite production crossed one billion tonnes in 2023-24, a 6-7% YoY growth.

-

Simultaneously, India has seen surging deployment of renewables. In 2025, solar generation in January to April rose ~32.4% over the previous year. Clean power capacity has crossed 50% of installed capacity ahead of schedule.

-

-

Policy Ambitions vs. Slow Implementation

-

In 2020, India launched a Coal Gasification Mission, aiming to gasify 100 million tonnes (MT) of coal by 2030.

-

The Union Cabinet approved a scheme with an outlay of ₹8,500 crore (~US$1+ billion) to promote gasification projects.

-

But actual progress has lagged, in many cases due to trouble finding buyers, technical difficulties, and site-specific issues. India first explored UCG and gasification technology in earlier decades (projects, R&D and committees trace back to the 1980s/1990s), but scale commercialisation remained elusive until renewed policy pushes.

-

-

The ONGC / UCG Case Study: A Cautionary Tale

-

ONGC ran an underground coal gasification (UCG) campaign at the Vastan block (Gujarat) for almost a decade but ultimately abandoned the project because syngas quality, prices and offtake did not work commercially. A recurring technical/market problem has been the low calorific value (energy quality) of syngas, which made it unattractive to buyers (one of the reasons ONGC/Gujarat experiments failed).

-

-

Growing Awareness of Ash, Water & Carbon Issues

-

Indian coal is high in ash content; this complicates gasification (more waste, higher filtration costs, more impurities) and reduces efficiency. Indian coal typically contains 25–45% ash, compared with 10–20% for many imported coals — a core technical challenge for gasification processes. The government sometimes spins this as a “feature,” but many experts push back.

-

There is concern about aquifer contamination, groundwater risks, especially with UCG and underground mining operations. These risks have been acknowledged officially. Past pilot projects and academic/NGO reports flagged aquifer contamination risks and ash/waste management as serious unresolved issues; the government acknowledges the problem and asserts solutions are possible, but monitoring and safeguards are required.

-

Carbon capture, utilisation and storage (CCUS) has been talked about more in recent years. But as of now, deployment has been very limited. India needs huge investment to make CCUS commercially viable.

-

-

Financial Viability & Demand Mismatch

-

Despite government schemes, many gasification projects have failed to attract offtakers. Projects often can’t compete on cost vs efficiency. Even with incentives, offtake risk (buyers for syngas, methanol, SNG) is material — historical failures (e.g., ONGC’s UCG) were driven by the inability to secure sustained buyers at viable prices. New projects must secure downstream demand or government procurement guarantees to be bankable.

-

The demand for downstream products (methanol, ammonia, synthetic natural gas) still relies heavily on imports. Methanol imports are especially large, meaning gasification could reduce import dependence — but only if projects are well designed and economic.

-

Why the Government Push Now: Energy Security, Emissions & Geopolitics

Why is India doubling down now?

-

Energy imports are expensive and geopolitically sensitive. India imports ~80% of its crude, ~50% of its natural gas. Coal gasification + syngas, methanol etc., can reduce this dependence. National strategy documents and studies (NITI, CSTEP) position methanol as a strategic fuel/chemical to reduce import dependence—methanol demand has historically been met mostly by imports (~95% as noted in analysis), motivating coal-to-methanol interest.

-

Clean energy goals and net zero by 2070. While renewables grow, they’re intermittent; coal & gas remain dispatchable. CCUS & gasification are being looked at as bridging technologies. The gasification roadmap recommends dedicated, nearby coal mines earmarked for gasification projects (auction-linked) to ensure consistent feedstock quality and logistics — a policy change vs older linkage regimes.

-

Coal reserves. India has vast coal reserves — proven and inferred — and wants better utilisation. Gasification (especially underground) promises better extraction of value.

-

Policy and investment signals: The government has set up schemes, financial incentives, and is clarifying auction rules, promoting underground mining, trying to level the playing field. This suggests seriousness. The government has created or supported CIL-BHEL and CIL-GAIL JVs to participate in gasification projects, signalling public-sector anchoring of the initiative. Multiple coal-gasification initiatives are being pursued regionally — e.g., Adani’s proposed Kalmeshwar project, Vidarbha projects (New Era Cleantech, WCL, Greta Energy) with central assistance (examples of funding ~₹1,000–1,300 crore for some projects).

-

The policy divides projects into categories with differential financial support (PSU projects, private projects, catalytic projects), offering up to a fixed % of CAPEX as incentive—aimed at bridging the high upfront capex.

The Risks: What Could Go Wrong

Given the history, the following are the main risks and challenges India must contend with:

-

Technological Mismatch

The existing gasification technologies may not suit high-ash, low-calorific coal. Unless the tech is adapted, many plants may underperform or fail commercially.

-

Low Energy Density & Poor Syngas Quality

Even when syngas is produced, its quality (calorific value, impurities) has historically been poor, meaning it doesn’t compete well with natural gas or imported fuels.

-

Environmental & Local Risks

Underground operations risk groundwater contamination, local environmental damage. Also, ash disposal, emissions unless CCUS is included. Official CCUS planning (NITI / CCUS reports) and recent Reuters coverage show India is preparing incentives for large CCUS deployment, with discussions of 50–100% support for selected projects, but real large-scale CCUS deployment remains nascent.

-

Financial Burdens and Subsidy Dependence

Many projects will need subsidies or viability gap funding. If profit margins are low or demand is uncertain, private investors may stay away unless risk is shared.

-

Regulatory, Auction, and Demand Uncertainty

Even if blocks are auctioned, lack of offtake agreements, unclear pricing, and uncertain demand for syngas, methanol, and ammonia can stall projects. India imported nearly $937 million worth of methanol in 2023 (major suppliers: Iran, Saudi Arabia, Oman), underscoring economic logic for domestic coal-to-methanol capacity if it can be made competitive. The National Coal Gasification Mission (2020) set targets and roadmaps; incentives were formalised in 2024 (₹8,500 cr), and auctions/roadshows / pre-bid schedules accelerated through 2024–25. Policy statements and current bids show an explicit push to promote underground mining and UCG over open-cast mining for selected blocks (to access unmineable seams and reduce surface impact).

-

Global vs Local Competing Pressures

While many countries are moving away from coal entirely, India is caught between climate goals and energy demand growth. Investments in coal gasification may be viewed skeptically by climate stakeholders or financial markets.

-

CCUS Lagging Behind

As of mid-2025, CCUS deployment in India is still nascent; massive scaling is required. Without large-scale carbon capture, gasification might emit a lot — defeating the claim of being ‘cleaner’. Government documents and mission papers estimate a multi-trillion rupee opportunity (investments worth several lakh crores over the decade) if targets are met — i.e., very large CAPEX needs across plants, CCUS, and downstream chemical units.

Is It a Visionary Move or Another Expensive Bet?

If India can successfully gasify 100 MT of coal by 2030, the upside in reducing import dependence for syngas, methanol, and ammonia is real. Financial savings, foreign exchange savings, and energy security gains are compelling. Creation of new industrial value chains: coal → syngas → petrochemicals → fertilisers → cleaner fuels. Jobs, especially in mining, chemical plants, gasification plants, underground mining infrastructure. If CCUS is paired properly, and environmental & social risks managed, gasification could be part of a lower-carbon transition path — not the end goal, but a bridging strategy.

But, reality of past failures (ONGC’s UCG project) shows that syngas projects can flounder for technical, economic, or demand side reasons. Unless the government ensures off-take, fair pricing, and financial support, many projects may become white elephants. Environmental costs and liabilities may be under-priced — groundwater, ash, emissions.

Opportunity cost: money and political capital invested here might otherwise accelerate renewables, battery storage, hydrogen, which globally are becoming cheaper and more scalable.

What India Should Do If It Wants This Strategy To Work

-

Technology Customization

Develop gasification systems that are explicitly designed for Indian coal quality (high ash, variable moisture, impurities). Encourage R&D, pilot plants, and tech transfer.

-

Ensure CCUS Is Part of the Plan

Budget, policy, and regulatory clarity for carbon capture & storage must accompany gasification. Without that, claims of cleaner coal are hollow.

-

Guarantee Offtake & Demand

Use government procurement or mandate downstream industries to buy synthetic gas, methanol etc., so that gasification plants have guaranteed markets.

-

Auction & Block Allocation Transparency

Auction mechanisms must be fair, transparent, and ensure that bidders have technical capability. Also, include environmental and social safeguards.

-

Financial & Policy Incentives

Viability gap funding, subsidies, risk-sharing with private entities. Possibly tax breaks, import duty reliefs for required equipment. Ensure that incentive schemes are stable, long-term.

-

Strong Environmental Regulation & Monitoring

Regulations for groundwater protection, ash disposal, emission standards. Also monitoring mechanisms, local community participation, third party audits.

-

Parallel Push on Renewables / Storage

Gasification can’t be an excuse to slow down deployment of solar, wind, battery, green hydrogen. India needs a diversified clean transition. Opportunity cost must be considered.

-

Regular Review & Pilots Before Scaling

Start with pilot projects with rigorous data collection, see what works (technically, financially, environmentally) before committing to large capital deployment.

India’s push into coal gasification is neither foolish nor foolishly timed. It has merit — the scale of coal reserves, import dependence, and energy demand growth suggest we can't just 'flip a switch' away from thermal power overnight. Gasification could be a bridge, and a transformative one — if done with care.

But there’s a risk: if the same oversights of past projects — low syngas quality, mismatch of technology, environmental neglect, subsidy dependence — repeat themselves, this may just become another chapter in India’s long history of over-promised energy solutions.

If the government and industry heed lessons from the last decade, bring in real technical clarity, environmental guardrails, and demand certainty, then India might just convert coal not just into syngas, but into strategic advantage. Otherwise, the risk is locking into a legacy energy path just as the tipping point for renewables and low-carbon technologies accelerates globally.

With inputs from agencies

Image Source: Multiple agencies

© Copyright 2025. All Rights Reserved. Powered by Vygr Media