The trade war between Washington and New Delhi has entered a new, perilous phase. With US President Donald Trump’s sweeping 50 per cent tariffs on Indian goods taking effect from today, some of India’s most labour-intensive industries stand exposed to an economic storm. For India, which has often touted its role as the world’s “growth engine,” this development is a sobering reminder of how fragile its global trade position truly is.

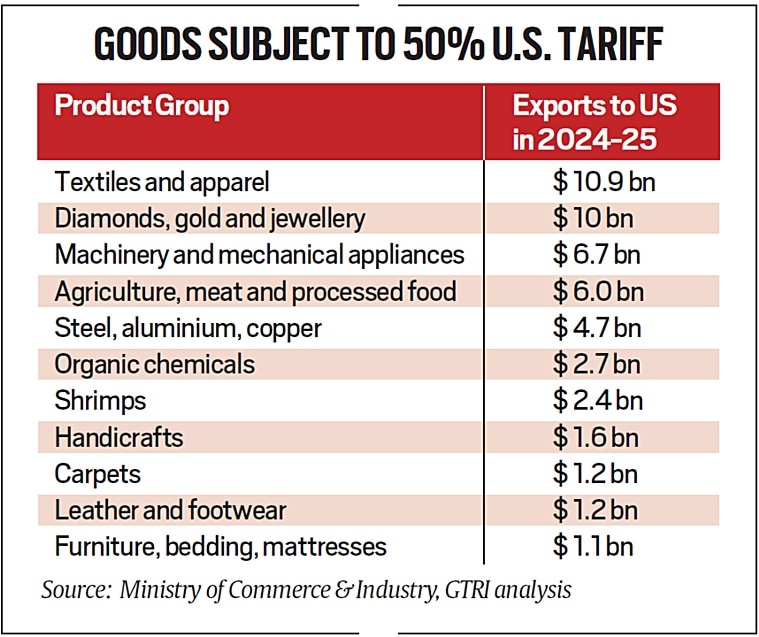

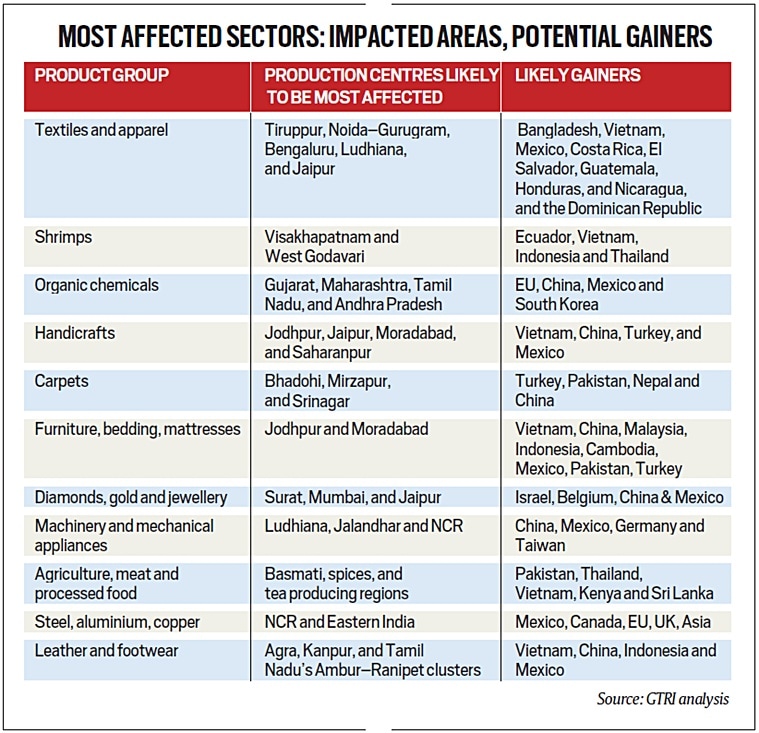

At the heart of the crisis lie India’s exports of textiles, apparel, gems and jewellery, shrimp, carpets, and furniture, sectors that are not only low-margin and labour-intensive, but also form the backbone of employment for millions of semi-skilled and low-skilled workers. Industry think-tank GTRI estimates that India’s merchandise exports to the US may plunge by as much as 45 per cent in 2025–26, shrinking from nearly $87 billion last year to just under $50 billion. This is not merely a setback on paper; it threatens livelihoods across cities like Surat, Tiruppur, Moradabad and Bhadohi, where entire communities rely on these trades.

The scale of the blow becomes clearer when broken down. Roughly 66 per cent of India’s exports to the US, worth over $57 billion, will now face the crushing 50 per cent tariff. Gems and jewellery, a sector where the US accounts for nearly a third of all trade, suddenly finds itself staring at massive order cancellations. The diamond polishing hubs of Gujarat, already struggling with shrinking margins, could see exports collapse by up to 70 per cent. Likewise, the shrimp industry, where the US represents nearly half of India’s export revenues, is bracing for plant shutdowns and job losses. Home textiles, carpets and handicrafts, where the US market constitutes between 50–70 per cent of sales are no less vulnerable.

What makes these tariffs doubly damaging is the geopolitical undertone. Trump’s administration has explicitly linked the additional 25 per cent “penalty tariffs” to India’s continued purchase of Russian oil and defence hardware. This linkage shifts the dispute beyond trade policy into the arena of strategic coercion. India, once celebrated in Washington as a counterweight to China, is now treated as a trade rival to be disciplined.

In this new reality, competitors such as Vietnam, Bangladesh, and Cambodia are poised to grab India’s lost market share. Even China and Pakistan, despite their own turbulent relations with Washington, stand to benefit. The irony is stark: while India speaks of becoming the world’s fourth-largest economy, its export backbone is being eroded by tariffs it can neither counter nor absorb.

Some categories, it must be noted, remain exempt. Pharmaceuticals worth $12.7 billion, electronics valued at $10.6 billion, and petroleum products of around $4 billion will still enter the US market without tariffs. Yet even here, Trump has dangled new threats from demanding pharmaceutical firms relocate to the US, to warning Apple against manufacturing in India. In other words, today’s exemptions may prove short-lived. The political ramifications in India could be severe. The textiles industry has already appealed for immediate relief, including cash assistance and a moratorium on loans, fearing mass layoffs. Gems and jewellery exporters have demanded partial reimbursement of tariffs to avoid collapse. But stop-gap relief cannot mask the deeper issue: India’s overdependence on a narrow band of export markets and products, many of which are highly sensitive to global demand shocks.

American economist Paul Krugman recently warned that the US economy itself is slipping into stagflationary pressures, and that tariffs are fundamentally inflationary. If this proves true, then Trump’s measures may hurt American consumers almost as much as Indian exporters. But while the US might absorb some inflation, India faces the far harsher prospect of millions of jobs at risk, particularly among workers with few alternative employment opportunities. This episode also exposes the fragility of India’s much-publicised growth story. Policymakers in New Delhi continue to speak of global leadership, digital revolutions, and headline GDP rankings. Yet, on the ground, sectors that employ millions and sustain export surpluses are being crippled by external shocks. If India cannot safeguard its workers from trade hostilities, claims of becoming an “economic powerhouse” ring hollow.

The question before the government is urgent: will it negotiate with Washington, accelerate free-trade agreements with Europe and others, or provide direct support to embattled industries? Delay is no longer an option. For if the 50 per cent tariffs remain in force, the “Made in India” label risks becoming synonymous not with competitive strength, but with a collapse in global demand.

With inputs from agencies

Image Source: Multiple agencies

© Copyright 2025. All Rights Reserved. Powered by Vygr Media.