Indian cryptocurrency exchange WazirX has fallen victim to a significant security breach, resulting in the unauthorized transfer of assets worth over $230 million. The affected assets include prominent cryptocurrencies such as Shiba Inu (SHIB), Pepe Coin (PEPE), Ethereum (ETH), and Polygon (MATIC).

WazirX Pauses Withdrawals Amid Wallet Hack

The breach involved the unauthorized transfer of funds from one of WazirX's multisignature wallets to an unknown address labeled “0x04b2,” according to blockchain tracking platform Lookonchain. In response, WazirX released an official statement on X (formerly Twitter):

“Update: We’re aware that one of our multisig wallets has experienced a security breach. Our team is actively investigating the incident. To ensure the safety of your assets, INR and crypto withdrawals will be temporarily paused. Thank you for your patience and understanding. We’ll keep you posted with further updates.”

Stolen Assets Dumped

The compromised wallet has been actively offloading the stolen assets. Key figures include:

-

640.27 billion PEPE tokens, valued at approximately $7.6 million.

-

20.5 million MATIC tokens, worth $11.2 million.

-

5.4 trillion SHIB tokens, valued at $102.1 million.

-

15,298 ETH, equivalent to $52.5 million.

These significant transfers have raised concerns among WazirX users about the safety of their funds. Despite this, WazirX has assured users of the safety of their funds and is working diligently to address the breach.

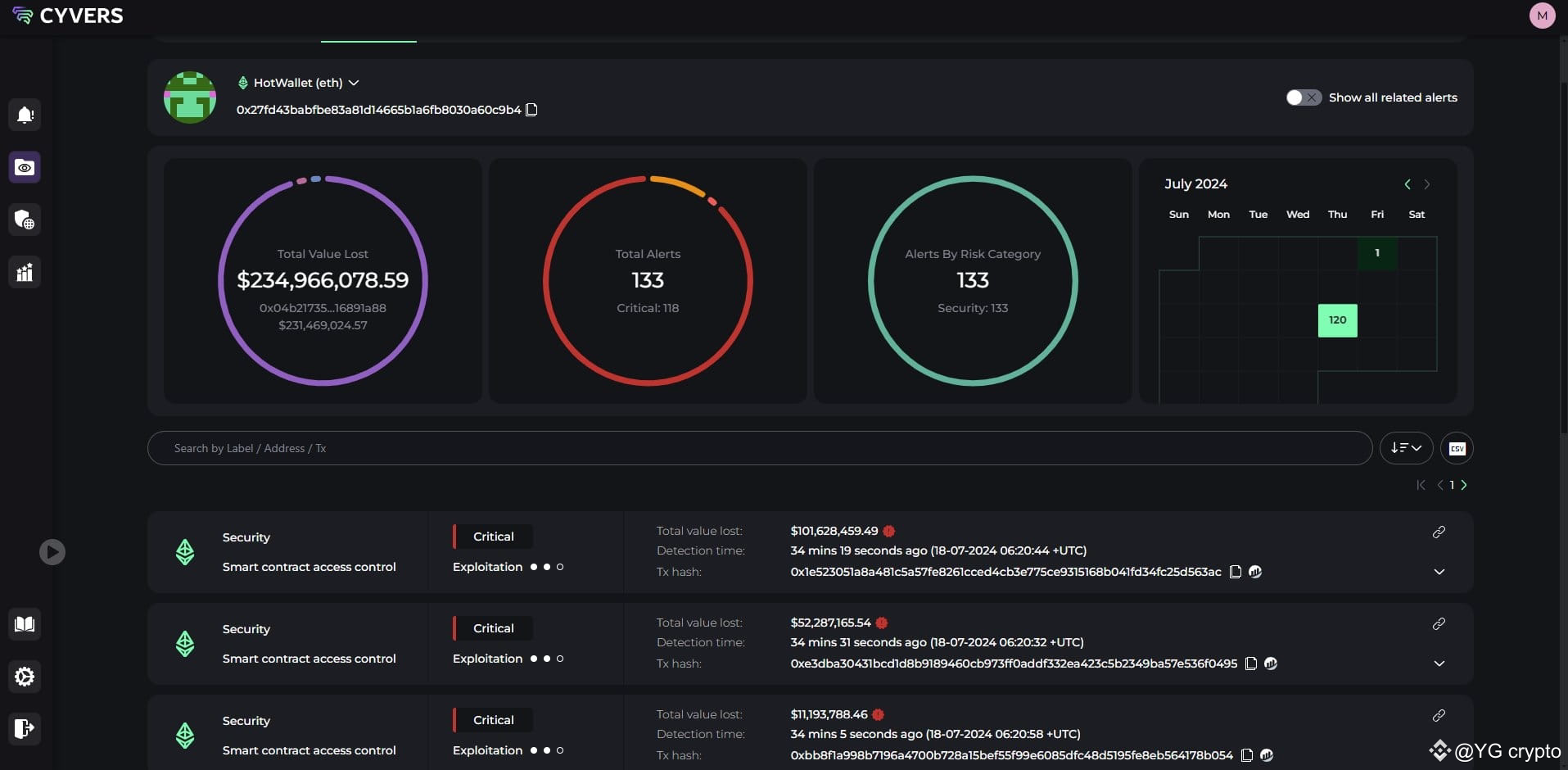

Hacker Uses Tornado Cash for Transfers

On July 18, 2024, Cyvers Alert detected multiple suspicious transactions involving WazirX’s Safe Multisig wallet on the Ethereum blockchain. These transactions, totaling approximately $234.9 million, were flagged due to their connection with Tornado Cash, a decentralized protocol for private transactions. Tornado Cash complicates the tracing of funds and the identification of involved parties.

Funds Traced to New Wallet Address

Following the transfers, the new address quickly exchanged significant portions of these funds into Ethereum. Notable swaps included Tether (USDT), Pepe Coin, and Gala (GALA). Further analysis revealed a diverse portfolio of digital assets held by the new address, including:

-

$4.7 million in Floki (FLOKI)

-

$3.2 million in Fantom (FTM)

-

$2.8 million in Chainlink (LINK)

-

$2.3 million in Fetch.ai (FET)

Challenges in Tracking and Regulatory Concerns

The hacker's use of Tornado Cash highlights the difficulties in tracking the origins and destinations of funds within decentralized finance (DeFi) ecosystems. These transactions raise concerns about potential money laundering and illicit activities, underscoring the need for enhanced regulatory oversight in the cryptocurrency space.

With inputs from agencies

Image Source: Multiple agencies

© Copyright 2024. All Rights Reserved Powered by Vygr Media.