As trade tensions between China and the United States continue to mount, attention has largely been focused on the volley of tariffs both nations have been imposing on each other. But tariffs are not China’s only weapon in this economic confrontation. Beijing has recently tightened export controls on a group of crucial rare earth minerals and magnetic materials—delivering a significant strategic blow to Washington. This move has highlighted America’s heavy dependence on China for these essential resources.

In response, US President Donald Trump has directed the Commerce Department to explore options for boosting domestic production and reducing reliance on overseas suppliers. But why are rare earth elements so vital—and why does China’s grip on this sector matter so much?

What Are Rare Earths and Why Are They Important?

Rare earths refer to a group of 17 chemically similar elements that are vital to the production of many modern technologies. Though not particularly scarce in the earth’s crust, they are difficult to extract and purify, which makes processing them a complex and environmentally taxing operation. You may not know elements like Neodymium, Yttrium, or Europium by name, but they’re embedded in everyday and advanced technologies—from smartphones and electric vehicles to medical imaging machines and military-grade weaponry.

Neodymium, for example, is used to create powerful magnets found in computer hard drives, speakers, EV motors, and jet engines—making devices smaller and more efficient. Yttrium and Europium are key in producing vivid colour displays in screens. The medical and defence sectors also rely heavily on these minerals for devices like MRI machines and precision-guided munitions. As Thomas Kruemmer, Director of Ginger International Trade and Investment, puts it: “Everything you can switch on or off likely runs on rare earths.”

How Much Control Does China Hold?

At present, China dominates both the mining and processing of rare earth materials. According to the International Energy Agency (IEA), China was responsible for about 61% of global rare earth extraction and a staggering 92% of refining activity in 2023. This near-monopoly grants Beijing considerable leverage. Given that refining rare earths is a highly polluting and radioactive process, most countries—including those in the European Union—have steered clear of large-scale production, citing environmental and safety concerns.

Mr Kruemmer notes that disposing of the radioactive by-products requires “safe, compliant, permanent disposal facilities”—something the EU lacks at present. China’s dominance is no accident; it is the result of deliberate long-term planning. Back in 1992, Deng Xiaoping famously remarked: “The Middle East has oil, China has rare earths.” Since then, China has heavily invested in this industry, often with more lenient environmental regulations and lower labour costs, undercutting global rivals and cementing control over the entire supply chain—from raw materials to end products like magnets.

What Restrictions Has China Imposed?

In retaliation to US tariffs, China has introduced fresh export controls on seven rare earth elements—primarily the heavier and more strategically valuable ones used in defence. As of 4 April, any firm wishing to export these rare earths and magnets must first obtain special licences. As a member of the Treaty on the Non-Proliferation of Nuclear Weapons, China is permitted to regulate the export of “dual-use” items—those with both civilian and military applications. Analysts at the Centre for Strategic and International Studies (CSIS) warn that this development puts the US in a precarious position, as there is currently no alternative global facility with the ability to process heavy rare earths outside China.

What Does This Mean for the US?

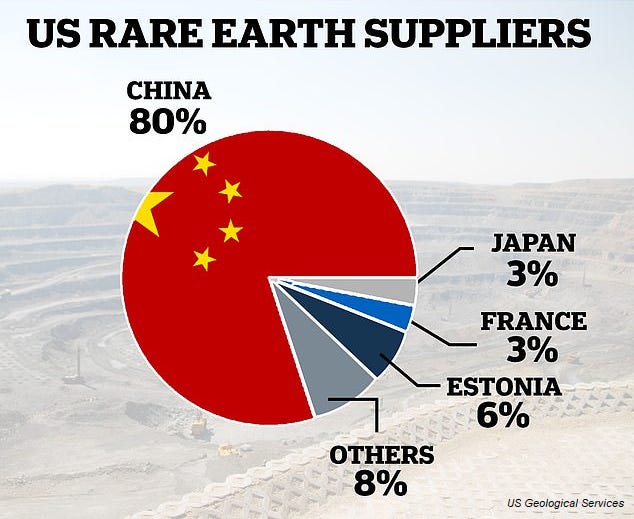

Between 2020 and 2023, the United States relied on China for 70% of its rare earth compound and metal imports, according to the US Geological Survey. The new Chinese restrictions could therefore disrupt key American industries, particularly those involved in high-tech and defence manufacturing. Heavy rare earths are essential in producing missiles, radar systems, jet fighters, and other defence technologies. CSIS notes that US military assets such as the F-35 fighter jet, Tomahawk missiles, and Predator drones are all dependent on these materials.

This comes at a time when China is significantly ramping up its own defence capabilities—allegedly outpacing the US by a factor of five or six in terms of munitions production and weapons procurement. Dr Gavin Harper, a research fellow at the University of Birmingham, warns that American manufacturers—especially those in defence and advanced electronics—face serious risks. “Shortages and delays are likely, and prices for rare earths are expected to rise, putting pressure on production timelines and costs,” he said.

If the supply squeeze persists, the US may look to diversify its sources and invest in domestic extraction and refining capabilities. But experts caution that this transition would demand major investment, innovation, and could still result in higher costs than importing from China. President Trump, evidently aware of these vulnerabilities, has ordered a national security review of America’s rare earth supply chains, warning that overreliance on foreign materials poses threats to both national defence and economic stability.

Why Can’t the US Just Produce Its Own?

The US does have one active rare earth mine, but it lacks the ability to process heavy rare earths domestically. Even today, mined ore is often shipped to China for refining. Although the United States was once a global leader in rare earth production—particularly during the 1980s—its industry faltered as Chinese producers offered lower prices and scaled up rapidly. There is speculation that Trump’s interest in mineral-rich countries like Ukraine and Greenland is driven in part by a desire to diversify America’s supply of rare earths. Greenland, notably, has the world’s eighth-largest reserves of these elements. However, Washington’s strained relations with many resource-rich nations—fuelled by tariffs and antagonistic rhetoric—could make securing alternative supply lines more difficult.

“The US finds itself in a dilemma: it’s alienated China, which holds a monopoly, and it’s also pushing away friendly nations through combative trade policies,” says Dr Harper. “Whether America can rebuild collaborative partnerships in this unstable policy landscape remains to be seen.”

With inputs from agencies

Image Source: Multiple agencies

© Copyright 2025. All Rights Reserved Powered by Vygr Media.