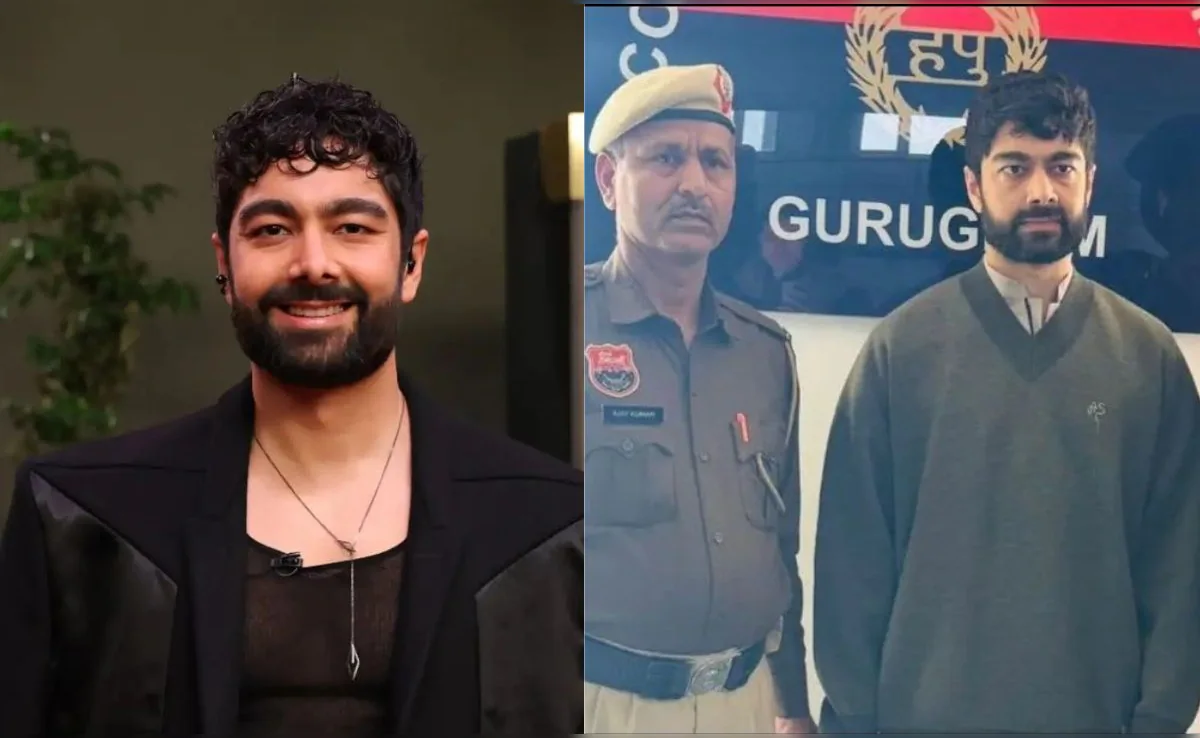

The arrest of Dhruv Dutt Sharma, founder, CEO and managing director of Gurugram’s popular commercial hub 32nd Avenue, has exposed what investigators describe as one of the most serious alleged real estate frauds in recent years. Sharma has been accused of selling the same commercial property multiple times—most notably, a single floor of a building allegedly sold to over 25 buyers—resulting in estimated losses of nearly ₹500 crore.

The case has sent shockwaves through India’s commercial real estate sector, raising urgent questions about investor protection, regulatory oversight, and the risks associated with assured-return property schemes.

Arrest and Police Custody

Dhruv Dutt Sharma was arrested by the Gurugram Police on Friday following an investigation led by the Economic Offences Wing (EOW). He was produced before a city court and remanded to six days of police custody for interrogation.

According to police officials, the arrest followed multiple complaints alleging cheating, criminal conspiracy, and fund diversion linked to property transactions at the 32nd Milestone complex, also known as 32nd Avenue. Investigators estimate the total financial impact of the alleged fraud to be around ₹500 crore, though the final figure could rise as more complaints emerge.

A spokesperson for the Gurugram Police confirmed that Sharma is currently being questioned to determine the full scope of the operation, identify accomplices, and trace financial transactions connected to the deals.

Who Is Dhruv Dutt Sharma?

Dhruv Dutt Sharma, 34, is a US-educated entrepreneur widely known as the face behind 32nd Avenue, a European-style mixed-use commercial development in Gurugram that houses high-end restaurants, cafés, retail outlets and entertainment spaces.

A graduate of Boston University, Sharma previously founded GuestHouser, a vacation rental platform, and was featured in the Forbes 30 Under 30 Asia list in 2018. Since 2015, he has overseen multiple real estate ventures under the 32nd brand across Delhi NCR, Hyderabad and Goa.

His arrest has therefore drawn significant public attention, with many investors and industry observers expressing shock that such large-scale alleged irregularities could occur at a project considered both premium and professionally managed.

The Complaint That Triggered the Investigation

The case originated from a complaint filed in January by a representative of Tram Ventures Private Limited. The complaint was lodged against Apra Motels Private Limited, which was later renamed 32 Milestone Vistas Private Limited.

According to the complaint, in 2021, the directors and shareholders of Apra Motels approached Tram Ventures with an offer to sell a 3,000 square foot commercial unit—Unit No. 24—located on the first floor of the 32nd Milestone complex.

The deal was reportedly finalised at ₹2.5 crore, and the full payment was made on September 21, 2021. An agreement to sell was executed, and rent for the unit continued to be paid to the complainant as per the agreement, initially giving the impression that the transaction was legitimate.

However, the complainant alleged that despite repeated follow-ups, the conveyance deed transferring ownership of the property was never executed or registered in its name.

Discovery of Multiple Sales

After months of unanswered requests and growing suspicion, Tram Ventures issued a legal notice in October 2023. When there was still no response, internal checks were conducted.

It was during this process that the complainant allegedly discovered that between 2022 and 2023, the conveyance deed for the same floor had been executed in favour of 25 different individuals.

Based on these findings, a police case was registered at the Civil Lines police station under sections related to cheating and criminal conspiracy.

During preliminary investigation, police stated that Sharma admitted that although a deal had been struck with the complainant in 2021 for the first floor of the building, the conveyance deed was never executed in the complainant’s name.

Instead, the same floor was allegedly sold to 25 other buyers.

Role of Growth Hospitality Private Limited

Police further revealed that after selling the floor to multiple individuals, the property was taken on a 30-year lease from all 25 buyers under the name of another firm—Growth Hospitality Private Limited.

This arrangement allegedly allowed rental income to continue flowing while masking the underlying ownership irregularities. Investigators believe this structure played a key role in delaying detection of the alleged fraud.

Expansion of the Probe and Multiple FIRs

As news of the case spread, additional investors came forward with similar allegations. Officials said that over five FIRs have been registered so far, with statements recorded from 40 to 50 complainants.

However, police suspect the actual number of affected investors could range between 500 and 1,000, with each individual allegedly cheated of amounts between ₹1 crore and ₹2.5 crore.

The matter first surfaced publicly around two months ago when investors approached the Police Commissioner’s public hearing, alleging large-scale cheating and non-payment of promised returns. Given the magnitude of the claims, the case was transferred to the EOW for detailed investigation.

Allegations of Assured Returns and Fund Diversion

According to police, Sharma and his associates allegedly lured investors by offering assured rental returns for periods extending up to 30 years. Investors were also promised buyback options, regular monthly income, and secure possession of demarcated commercial units.

Many buyers invested crores based on these assurances. However, police said rental payments allegedly stopped from August 2025, and statutory dues—including TDS, GST, PF and ESI—were not deposited despite repeated commitments.

Investigators also allege that several property units were sold to multiple buyers, raising doubts about whether genuine possession could ever be delivered.

When investors demanded possession or attempted to invoke buyback clauses, promoters reportedly expressed their inability to comply, deepening suspicions of systematic misrepresentation.

Alleged Use of Funds and Asset Purchases

During preliminary questioning, Sharma allegedly admitted that funds collected from investors were diverted to luxury investments. Police are examining claims that the money was used to purchase high-end villas along Goa’s coastline and properties in Neemrana, Rajasthan.

The EOW is now working to trace the full money trail, identify additional beneficiaries, and determine whether the alleged diversion of funds was part of a larger, organised scheme.

Legal Action by Investors and Court Proceedings

Parallel to the police investigation, legal proceedings have also intensified. A Gurugram court recently sought an action-taken report on a plea filed by senior citizen investor Arvind Gupta.

In his application, Gupta accused the promoters of cheating, forgery, intimidation and criminal conspiracy. The plea names 32nd Vistas Pvt Ltd, Growth Hospitality LLP, and promoters Dhruv Dutt Sharma, Shirin Sharma and Mamta Sharma.

The petition has sought multiple reliefs, including freezing of bank accounts, attachment of assets, forensic audits, suspension of passports and issuance of look-out circulars to prevent the accused from leaving the country.

Gupta also alleged that fabricated TDS certificates were circulated to mislead investors into believing that statutory compliance had been completed.

Operational Issues and Investor Protests

The plea further claimed that despite rental income being generated from operational restaurants and retail outlets at the project, dues to investors, employees and government authorities remained unpaid.

As a result, utilities were allegedly disconnected, protests erupted at the site, and offices were eventually shut. In recent weeks, Gurugram Police also registered FIRs against owners and officials linked to 32nd Avenue after investors protested over unpaid promised returns.

What Lies Ahead

With Dhruv Dutt Sharma now in police custody, the EOW has said its immediate focus will be on tracing diverted funds, identifying all beneficiaries, and verifying whether the same properties were repeatedly sold as part of what police describe as a planned and large-scale real estate fraud.

The case has sparked widespread debate online, with social media users questioning how such transactions went undetected for years and calling for stricter safeguards, particularly for buyers investing in pre-leased or assured-return commercial properties.

As the investigation continues, its outcome is likely to have far-reaching implications—not just for the future of the 32nd Avenue project, but for transparency, compliance and investor confidence in India’s commercial real estate market as a whole.

With inputs from agencies

Image Source: Multiple agencies

© Copyright 2025. All Rights Reserved. Powered by Vygr Media.