India’s Goods and Services Tax (GST) regime is undergoing its most ambitious overhaul since its introduction eight years ago. In a landmark decision, the GST Council, chaired by Union Finance Minister Nirmala Sitharaman and guided by Prime Minister Narendra Modi’s vision, has approved a radical simplification of the indirect tax structure.

Effective September 22, 2025—coinciding with the start of Navratri and just ahead of Durga Puja and Diwali—the country will transition from a four-tier GST system (5%, 12%, 18%, and 28%) to a streamlined dual structure of 5% and 18%, with a special 40% rate reserved for luxury and sin goods.

The timing could not have been more strategic. With households preparing for the festive season and businesses eyeing a demand revival, GST 2.0 is being hailed as both a political masterstroke and an economic necessity.

Why GST 2.0 Matters Now

The reforms come against a backdrop of global economic turbulence. The United States’ recent imposition of 50% tariffs on $60 billion worth of Indian exports—including textiles, seafood, leather, and gems—has rattled export-dependent sectors and raised fears of job losses in hubs like Tirupur, Surat, and Noida.

Economists warn that India’s GDP growth could be clipped by 0.4% to 0.6% in FY26 due to these trade shocks. In this climate, boosting domestic consumption has become critical. The GST overhaul is designed not only to ease the burden on the common man but also to stimulate demand across industries, thereby shielding the economy from external headwinds.

As Modi declared during his Independence Day address:

“This reform is not just about rationalising rates. It’s also about ease of living, ensuring that businesses can operate with great ease, and providing predictability about GST.”

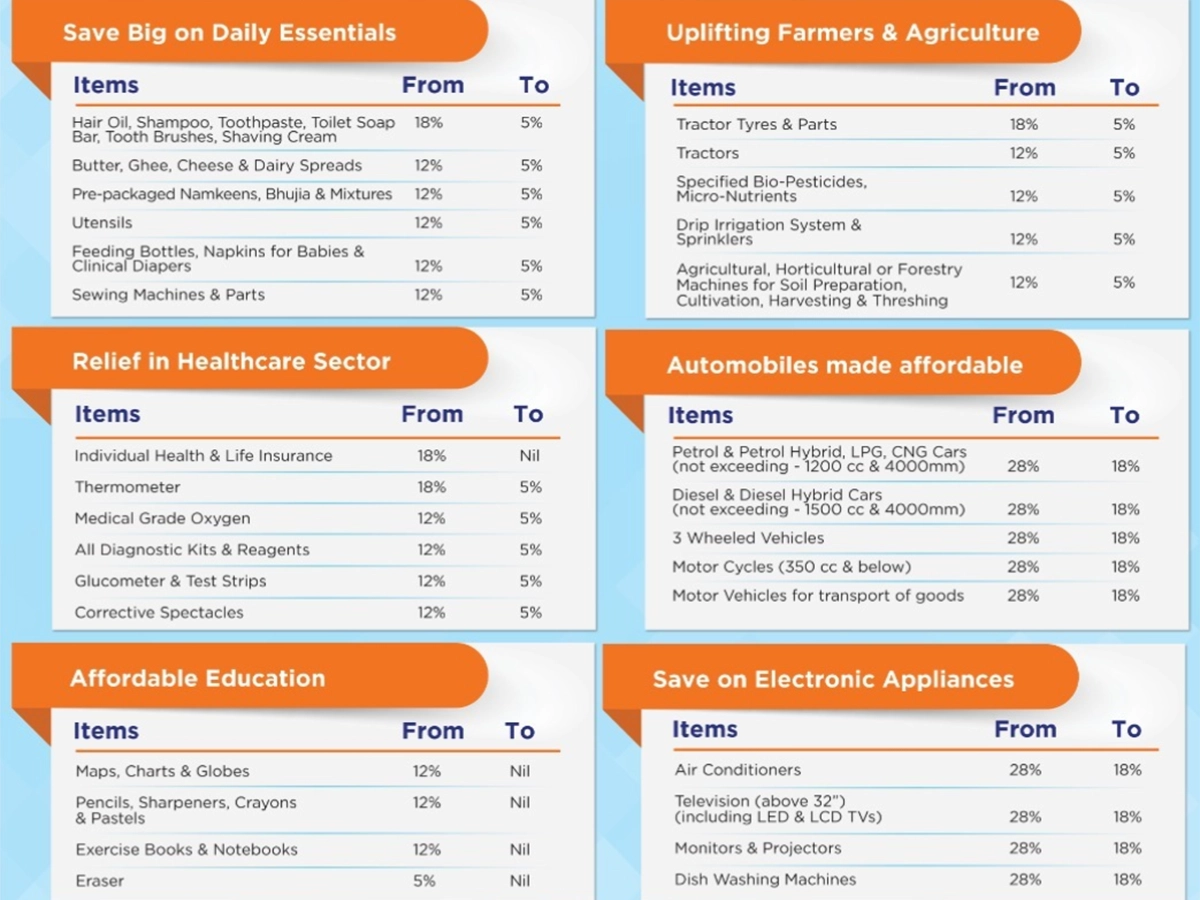

What Gets Cheaper Under GST 2.0

The most immediate and visible impact will be on everyday essentials. Products that touch daily lives—from groceries to personal care items—have seen significant reductions:

-

Daily essentials like hair oil, soaps, toothpaste, shaving cream, combs, and bicycles will now be taxed at 5% instead of 12–18%.

-

Dairy products—butter, ghee, cheese, paneer, and condensed milk—drop to 5% from 12%.

-

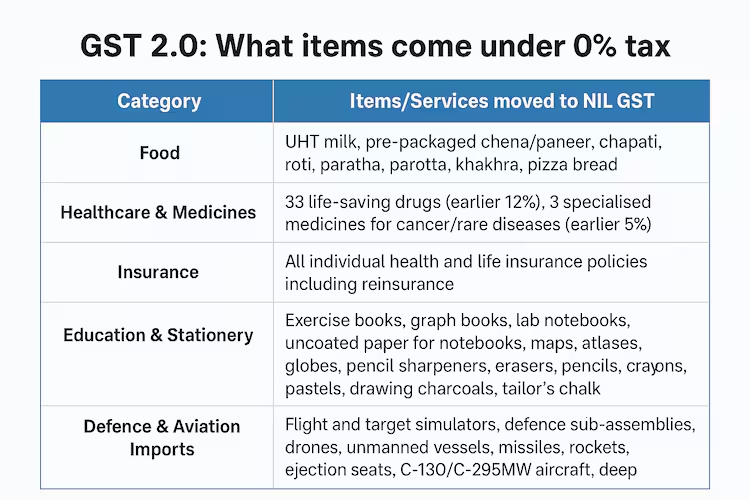

Kitchen staples including biscuits, chocolates, cocoa products, refined sugar, syrups, candy, malt, starches, pasta, and cornflakes move into the 5% slab. Ultra-heat-treated (UHT) milk, frozen parathas, chapatis, khakhra, and pizza bread will be GST-free.

-

Snacks and processed foods—from namkeens, bhujia, pickles, jams, sauces, and soups to popcorn (both loose and pre-packed)—will be taxed at 5%, compared to the earlier 12–18%. Caramel popcorn, however, remains at 18%.

-

Dry fruits like almonds, pistachios, cashews, hazelnuts, and dates have been moved from 12% to 5%, making festive gifting more affordable.

-

Healthcare essentials such as medical-grade oxygen, diagnostic kits, thermometers, glucometers, and corrective spectacles will attract only 5% GST, while life-saving drugs for cancer and rare diseases are completely exempt.

-

Education supplies, including notebooks, pencils, crayons, erasers, maps, and globes, have been granted full exemption.

-

Dining out also becomes lighter on the wallet. Restaurants will now be taxed at 5%, meaning families could save an estimated ₹200–400 per month on dining bills, a welcome relief during the festive and wedding season.

The GST rationalisation also covers personal care and household goods: shampoos, tableware, umbrellas, bamboo furniture—all at 5% now, easing middle-class budgets.

Big-Ticket Savings: Electronics, Cars, and Insurance

-

Consumer Durables

Appliances such as air conditioners, refrigerators, washing machines, and large-screen TVs will now be taxed at 18% instead of 28%, a move expected to spur festive shopping sprees. For manufacturers and retailers facing sluggish demand, this cut could not be more timely.

-

Automobiles

Car buyers, especially middle-class families, will rejoice:

-Small cars and two-wheelers (like the Maruti Alto, Tata Punch, Hyundai i10) now fall under 18% GST instead of 28%, making them more affordable.

-Luxury cars and premium bikes remain in the 40% slab, ensuring that the principle of taxing luxury at higher rates stays intact.

-

Insurance

Another major relief comes in the removal of GST on life and health insurance premiums. Policies—whether term life, ULIPs, or endowment—will now be tax-free, making coverage accessible to millions.

-

Healthcare

Over 30 critical drugs, including life-saving cancer treatments, have been exempted from GST entirely. Essential medical devices like thermometers, oxygen, glucometers, and diagnostic kits are capped at 5% GST. For patients and families battling high healthcare costs, these changes are transformational.

Relief for Households and Middle-Class Consumers

For the middle-class family, food inflation and healthcare expenses have long been pressing concerns. GST 2.0 addresses both.

Cheaper groceries and personal care items will reduce monthly household expenditure, while GST exemptions on life and health insurance premiums make financial protection more accessible. Families purchasing appliances during Navratri and Diwali—such as refrigerators, washing machines, and air conditioners—will now pay 18% instead of 28%, a cut that could save thousands of rupees.

Finance Minister Sitharaman summed it up:

“These reforms have been carried out with a focus on the common man. Every tax on the common man’s daily use items has gone through a rigorous review and in most cases the rates have come down drastically. Labour-intensive industries have been given good support. Farmers and the agriculture sector, as well as the health sector, will benefit.”

A Boost for Farmers and Agriculture

Agriculture, the backbone of India’s economy, has received targeted support.

-

Tractors and tractor parts reduced to 5%, from earlier 12–18%.

-

Agri-inputs like bio-pesticides, micronutrients, drip irrigation systems, and machinery now fall under the 5% slab, cutting input costs.

This will directly support farmers struggling with rising costs and global market disruptions. Prime Minister Modi has consistently reiterated his government’s commitment:

“For us, the interest of our farmers is our top priority. India will never compromise on the interests of farmers, fishermen, and dairy farmers.”

This stance is critical as India resists pressure in global trade negotiations to open up sensitive agricultural markets.

What Gets Costlier?

While GST 2.0 is primarily focused on relief, the government has reserved higher taxes for luxury and demerit goods to maintain a progressive balance.

-

Vehicles: Small cars and motorcycles up to 350cc will attract 18% GST, while premium motorcycles, luxury cars, and aircraft for personal use fall under the 40% slab.

-

Tobacco and pan masala: Cigarettes remain at 28% GST plus cess, while other tobacco products and pan masala now attract 40% GST.

-

Sugary and fizzy drinks: Carbonated drinks, fruit-based sodas, and popular aerated beverages from companies like PepsiCo and Coca-Cola will face the 40% slab.

-

Coal: Taxed sharply higher, from 5% to 18%, which may affect power and industrial costs.

-

Luxury apparel: Clothing and accessories above ₹2,500 will attract 18% GST, up from 12%.

By shifting the tax burden to luxury and sin goods, the reforms ensure that relief flows primarily to the common man and middle class, while wealthier households bear proportionally more.

Support for Industries and Businesses

The reforms have major implications for FMCG, food processing, and manufacturing industries. With reduced tax rates on raw materials and finished goods, companies can streamline costs, expand into new markets, and innovate.

As Akash Agrawalla, Co-founder of ZOFF Foods, explained:

"The new GST reforms mark a pivotal moment for India’s FMCG and food processing industries. By rationalising tax slabs and reducing rates, the government is boosting demand, easing compliance, and supporting homegrown brands. At ZOFF Foods, we see this as a timely, progressive move that allows us to scale faster, innovate more, and offer even better value to our consumers, especially with the festive season ahead. It will also help us accelerate market expansion across Tier 2 and Tier 3 cities, unlocking new growth corridors for the sector at large"

Labour-intensive sectors such as textiles, gems, and leather—hit by U.S. tariffs—are expected to benefit indirectly from rising domestic demand supported by GST 2.0.

Drones and Technology: A Big Winner

One of the less obvious but high-potential sectors to benefit is drone technology. With GST on drones slashed to 5%, affordability will increase for farmers, defence, surveillance, and logistics applications.

Agnishwar Jayaprakash, Founder and CEO of Garuda Aerospace, highlighted the wider implications:

"We welcome this landmark move and believe that the reduction of GST to 5% will empower drone-tech companies in multiple ways. For companies like Garuda Aerospace, which strongly believe that indigenous drones are the need of the hour, this reform provides the opportunity to deepen investments in R&D, foster innovation, and scale up manufacturing. Lower costs also enable us to explore entry into new markets, encouraging and promoting the wider use of drones. This move directly improves the affordability of drones for farmers and allied sectors, further boosting the adoption of agri-drones across the country. It is also a step forward for initiatives like NaMo Drone Didi, which promote precision agriculture through drone usage. Moreover, it equips defence and surveillance sectors with cost-effective drone solutions for public safety, disaster management, and other critical applications. We anticipate that this progressive step towards making India the global hub for drone technology and being Atmanirbhar Bharat will enhance productivity and efficiency, while accelerating drone adoption across industries such as logistics and infrastructure."

By incentivising indigenous drone innovation, the government is aligning GST reforms with its Atmanirbhar Bharat (self-reliant India) vision.

![]()

Political Timing and Economic Strategy

The rollout of GST 2.0 is not merely economic housekeeping. It is deeply political. With state elections in Bihar looming and global uncertainties pressing, the reforms serve as both populist relief and a structural reset.

By easing financial pressure on the middle class, farmers, and small businesses while taxing luxury consumption more heavily, the government has positioned itself as both pro-growth and pro-poor.

At the same time, the reforms correct long-standing issues such as inverted duty structures and classification disputes, making the GST framework more predictable and business-friendly.

GST 2.0 as India’s Next Big Leap

Coupled with the government’s earlier move to exempt annual income up to ₹12.75 lakh from income tax, GST 2.0 represents a powerful twin relief package for India’s middle class. Disposable incomes will rise, consumption is set to surge, and industries will gain a stronger domestic base even as global uncertainties persist.

In the words of PM Modi:

“The wide-ranging reforms will benefit… the common man, farmers, MSMEs, middle-class, women and youth.”

As festive lights brighten Indian homes this Navratri and Diwali, the timing of GST 2.0 couldn’t be more symbolic. It’s not just a tax reform—it’s a statement of resilience, signalling India’s readiness to protect its people, empower its industries, and chart its own path amid turbulent global currents.

With inputs from agencies

Image Source: Multiple agencies

© Copyright 2025. All Rights Reserved. Powered by Vygr Media.