In India’s culturally rich and financially evolving landscape, gold continues to be a cornerstone of investment portfolios in 2025. But today, investors have multiple formats to choose from—Sovereign Gold Bonds (SGBs), Digital Gold, and Physical Gold. Each format carries distinct benefits and limitations, making the choice more nuanced than ever.

So, which form of gold investment is right for you in 2025?

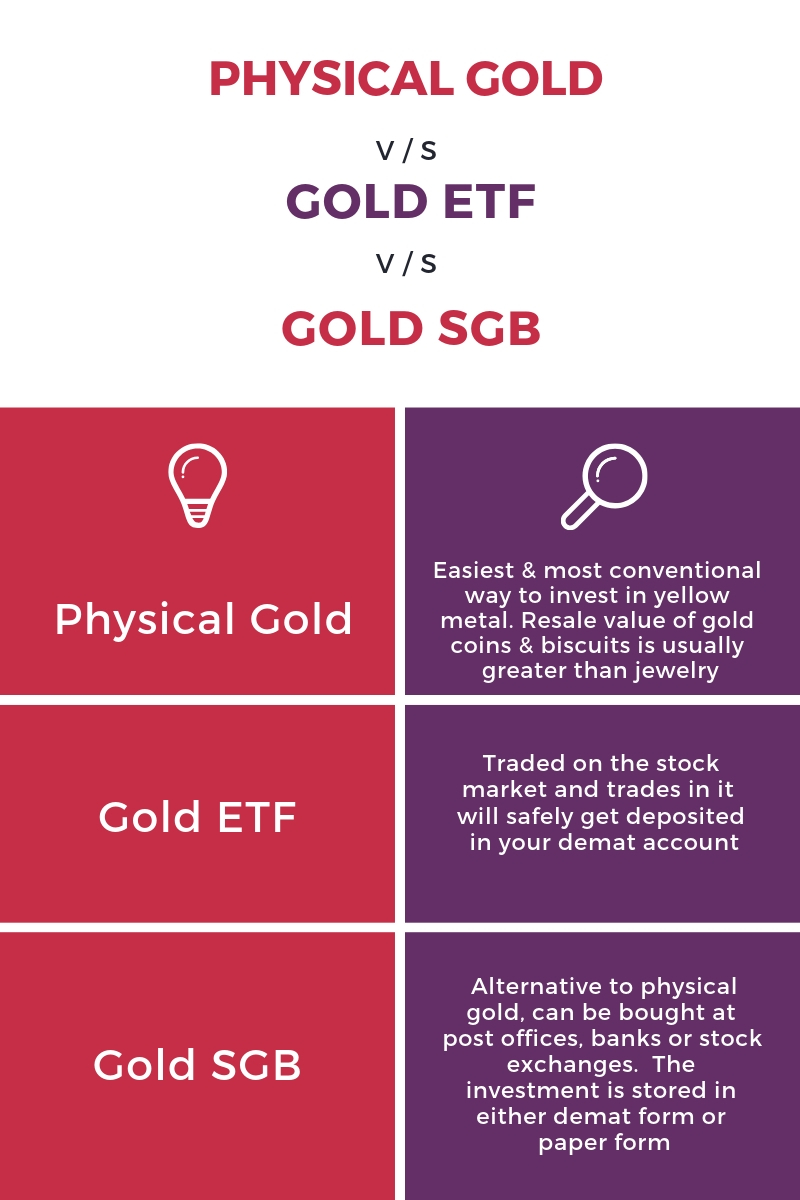

What Are Sovereign Gold Bonds (SGBs)?

Sovereign Gold Bonds are government-backed securities issued by the Reserve Bank of India (RBI), denominated in grams of gold. When you invest in SGBs, you're essentially loaning money to the government and receiving interest plus the value of gold at maturity.

Key Features of SGBs in 2025:

-

Annual Interest: 2.5% per annum (paid semi-annually)

-

Tenure: 8 years (with exit options from the 5th year)

-

Minimum Investment: 1 gram

-

Maximum Limit: 4 kg (individuals), 20 kg (trusts)

-

Backing: 100% by the Government of India

Also read: Top Gold Investment Options in India for Smart Investors

What Is Digital Gold?

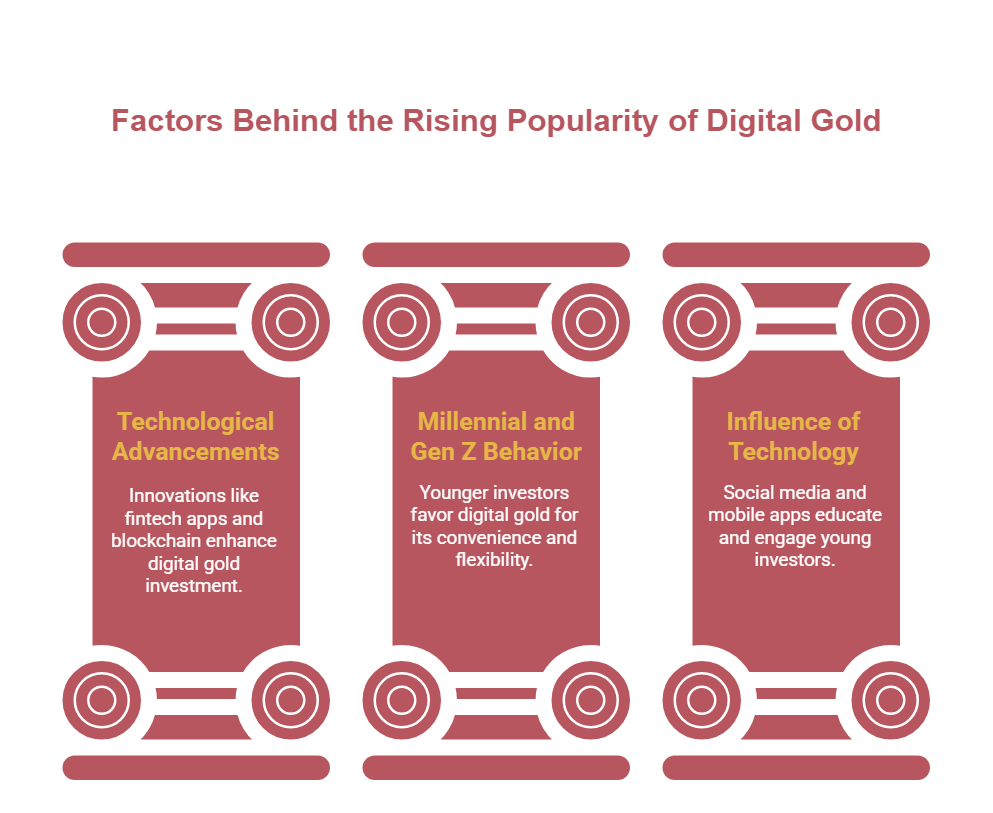

Digital gold allows investors to buy, sell, and store gold online without physically handling the metal. Reputed fintech platforms partner with custodians to store equivalent gold in secure vaults. Each gram you buy online is backed by actual, insured gold.

Innovations in Digital Gold (2025):

-

Fractional Ownership: Invest as little as ₹1 or 0.01 grams

-

UPI & SIP Integration: Automate your gold savings

-

Blockchain Auditing: Ensures transparency

-

24x7 Liquidity: Trade anytime from your smartphone

Core Features:

-

Purity: Usually 24K, 99.9% pure

-

Ownership: Fully backed by actual gold stored in vaults

-

Minimum Investment: Starts as low as ₹1

-

Liquidity: Instant buy/sell options online

-

Security: Protected by 2FA, encrypted vaults, and regulatory oversight

-

Tax: Similar capital gains treatment as physical gold

-

Storage: Handled by provider at no extra cost

What Is Physical Gold?

This is the most traditional form—jewelry, coins, and bars—that you can see, touch, and store at home or in bank lockers.

Despite digital alternatives, physical gold continues to hold its ground, thanks to its tangible value and cultural relevance, especially in India. In 2025, physical gold is not just a legacy asset but also an artful, collectible item.

New Trends:

-

Designer gold coins and artistic bars

-

Tamper-proof packaging

-

Unique serial numbers and microscopic anti-counterfeit markers

-

BIS hallmarking and NABL-certified refiners

-

Premium minted bars for investment-grade quality

Detailed Comparison: SGBs vs Digital Gold vs Physical Gold (2025)

|

Feature |

Sovereign Gold Bonds (SGBs) |

Digital Gold |

Physical Gold |

|---|---|---|---|

|

Returns |

2.5% interest + gold price |

Gold price |

Gold price |

|

Liquidity |

Medium (tradable after 5 years or on stock exchanges) |

High (instant online sale) |

Medium (sell at jewelers) |

|

Holding Format |

Demat or certificate |

Online account |

Tangible |

|

Minimum Investment |

1 gram |

₹1 (0.01g) |

0.5g or more |

|

Storage |

No storage needed |

Stored in insured vaults |

Requires locker/home safe |

|

Purity Assurance |

999 purity, government certified |

999 purity, verified by custodian |

Depends on source (look for BIS hallmark) |

|

Taxation |

LTCG exempt after 8 years |

20% LTCG after 3 years |

20% LTCG after 3 years |

|

Use in Emergencies |

Low (not easily liquidated) |

High |

High if kept at home |

|

Security Risks |

Virtually none |

Cybersecurity threats |

Theft, damage |

|

Other Benefits |

Interest income, no capital gains tax if held full term |

Micro-investments, ease of access |

Cultural/emotional value, legacy planning |

Why Choose Sovereign Gold Bonds in 2025?

SGBs are ideal for long-term, conservative investors who prefer capital protection and regular income.

Best Use Cases:

-

Retirement planning

-

Wealth preservation over decades

-

Risk-averse investors seeking government security

Advantages:

-

Guaranteed 2.5% annual return over gold appreciation

-

No worries about storage, security, or purity

-

Tax-free redemption after 8 years

Limitations:

-

Locked-in period of 5 years minimum

-

No physical delivery

-

Not ideal for short-term traders

Why Choose Digital Gold in 2025?

Digital gold appeals to tech-savvy, younger investors looking for convenience, flexibility, and automation.

Best Use Cases:

-

SIP-style gold accumulation

-

Short to medium-term investment

-

Building wealth without physical storage

Advantages:

-

Start with ₹1; no large capital needed

-

Sell anytime with instant settlement

-

Real-time price tracking and automated savings options

Limitations:

-

Platform-dependent access

-

Cyber risks if using unsecured apps

-

No interest income

Why Choose Physical Gold in 2025?

Physical gold is perfect for those valuing ownership, privacy, and tradition—especially for legacy or cultural reasons.

Best Use Cases:

-

Gifting or inheritance

-

Emergency funds stored at home

-

Conversion to jewelry for weddings/events

Advantages:

-

No reliance on digital platforms

-

Accepted everywhere, even in rural areas

-

Emotional and cultural satisfaction

Limitations:

-

Requires secure storage (home or bank locker)

-

Making charges + GST on jewelry

-

Risk of theft, loss, or damage

Security in 2025: A Key Differentiator

Physical Gold Security:

-

Biometric safes, GPS-tagged lockers, DNA-marked packaging

-

Bank locker rentals have risen; private vaults now in demand

-

Home security still poses theft risks

Digital Gold Security:

-

Multi-factor authentication, cold wallets

-

Blockchain audit trails and regulated platforms

-

Be sure to choose RBI-approved providers

Investment Strategies: How to Balance Gold in 2025

1. Combined Allocation Strategy

Most successful investors in 2025 are using a hybrid strategy to harness the best of all worlds:

-

50–70% in Physical Gold: As a long-term legacy and emergency reserve

-

20–30% in Digital Gold: For short-term liquidity and convenience

-

10–20% in SGBs: For safe, long-term growth with assured interest

2. Goal-Based Allocation

|

Financial Goal |

Best Gold Type |

|---|---|

|

Legacy & Wealth Transfer |

High-quality physical gold |

|

Emergency Fund |

Digital gold + small-denomination physical |

|

Regular Savings/Discipline |

Digital gold via SIPs |

|

Wedding Planning |

Start with digital, convert to physical later |

|

Retirement Planning |

Core SGBs + physical bullion for emergencies |

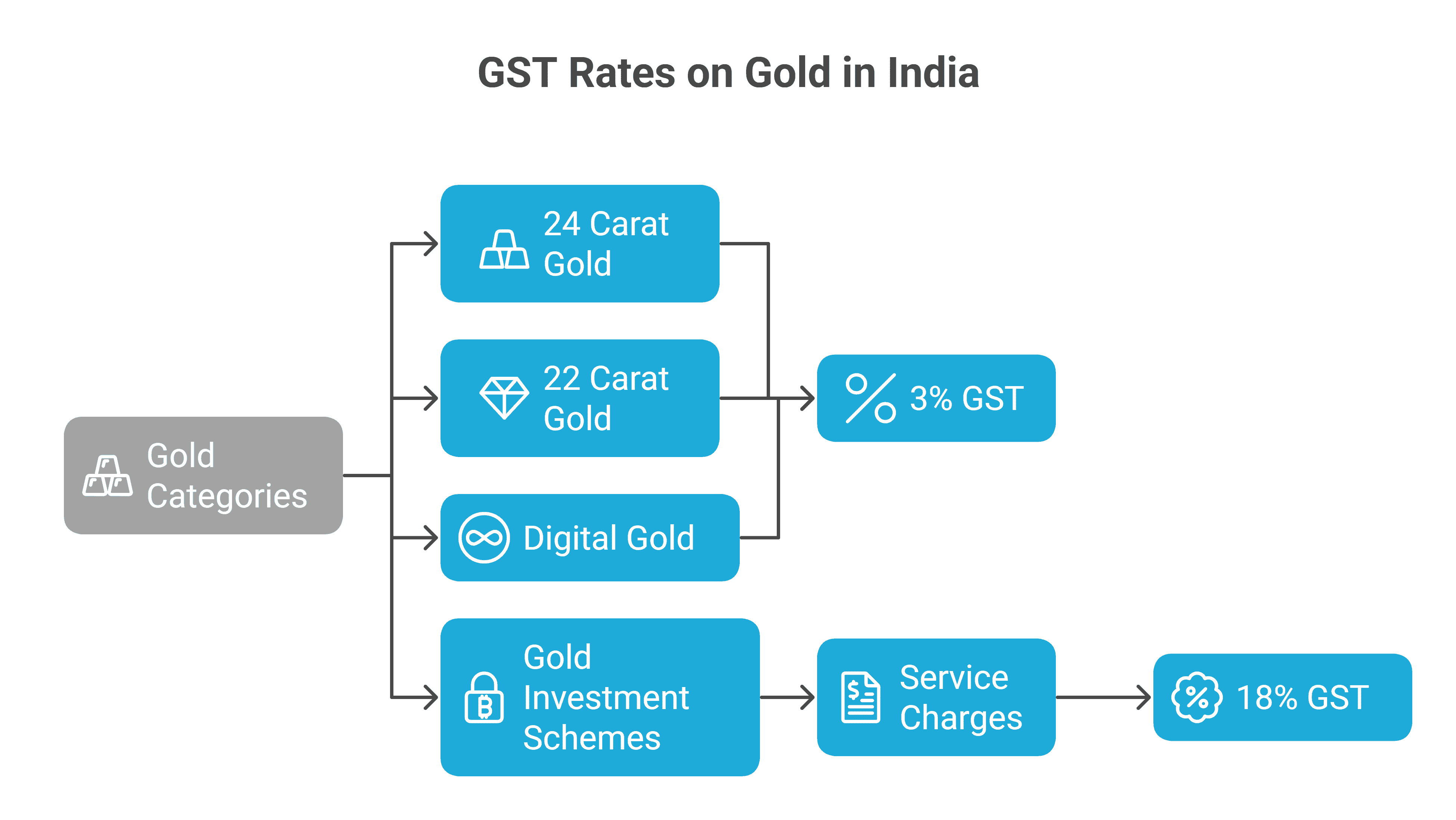

Taxation of Gold in 2025

Physical and Digital Gold:

-

Short-Term Capital Gains (STCG): If sold within 36 months, taxed as per income slab

-

Long-Term Capital Gains (LTCG): After 36 months, taxed at 20% with indexation

-

GST on Purchase: 3% for physical gold; not applicable on digital gold redemptions (except conversion to jewelry)

SGBs:

-

Interest Income: Taxable as per income slab

-

Capital Gains on Redemption: Tax-free if held till maturity

-

Secondary Market Sale: Gains taxable, but indexation benefit available

How to Get Started with Each Gold Format

1. Buying Physical Gold

-

Insist on BIS hallmark certification

-

Purchase from NABL-certified refiners

-

Demand an assay certificate for large transactions

-

Maintain a GST bill for resale and tax proof

-

Consider minted bars for better resale value

2. Investing in Digital Gold

-

Use regulated platforms (PhonePe, Paytm, Groww, etc.)

-

Check for vault insurance and gold backing

-

Understand the fee structure

-

Begin with small amounts to test reliability

-

Activate SIPs for steady accumulation

3. Buying Sovereign Gold Bonds (SGBs)

-

Purchase during RBI issuance windows or via secondary markets

-

Use demat accounts or RBI Retail Direct portal

-

Hold for 8 years to benefit from tax-free redemption

-

Diversify over multiple issuance dates for better averaging

Final Verdict: Which Gold Investment Is Best for You?

Ask yourself:

-

Do I need immediate liquidity? → Digital or Physical Gold

-

Am I planning for long-term wealth? → SGBs

-

Do I want to pass it on as family legacy? → Physical Gold

-

Is convenience my top priority? → Digital Gold

-

Am I looking for tax-efficient returns? → SGBs

Achieve the Golden Balance

In 2025, there's no single "best" gold investment. SGBs, digital gold, and physical gold each serve unique roles. The key is to blend tradition with innovation—balancing the safety of SGBs, ease of digital gold, and tangibility of physical gold.

By aligning your investments with your goals, risk tolerance, and lifestyle, you can strike the perfect golden balance—and build a future-proof portfolio.

With inputs from agencies

Image Source: Multiple agencies

© Copyright 2025. All Rights Reserved Powered by Vygr Media.