Nvidia has made headlines by acquiring a 4% stake in Intel, investing $5 billion in the company. This move is part of a broader partnership aimed at jointly developing cutting-edge chips for data centers and personal computers. This collaboration between two giant tech players marks a significant step in the semiconductor industry, especially given both companies’ histories and current market dynamics.

Nvidia announced this deal recently, stating that the investment would be made through the purchase of Intel common stock at a price discounted from Intel’s recent share price. The two companies plan to work together to create multiple generations of custom chips. These chips will integrate Intel’s CPUs with Nvidia’s advanced GPU technology, specifically leveraging Nvidia’s RTX GPU chiplets in x86 system-on-chips (SoCs). This integration is expected to improve performance in a wide range of PCs and data center servers. Importantly, the companies are also planning to link their products using Nvidia’s NVLink communication technology, which is widely used in data centers to enable fast GPU communications.

This partnership is important in the context of fierce competition in the semiconductor market, notably from AMD. AMD has been strong in the high-performance computing space, with powerful CPUs for gaming desktops and various AI-capable laptop processors. By working together, Nvidia and Intel aim to compete more effectively against AMD, with Intel gaining from Nvidia’s GPU expertise while Nvidia benefits from Intel’s CPU technology and manufacturing scale.

For Intel, which has faced challenges defending its market share against competitors, especially those using ARM technology, this partnership offers a lifeline. Intel still holds a significant share in x86 CPUs used worldwide but has seen increased pressure in both the PC and data center spaces. Nvidia’s recent investment also follows other supports Intel has received, including from the U.S. government and major investors like SoftBank, signaling confidence in Intel’s long-term potential despite recent struggles.

Nvidia’s CEO Jensen Huang described the collaboration as a fusion of two world-class technology platforms. He highlighted that the partnership will not only expand their ecosystems but also set the foundation for the next era of computing. This suggests that both companies are thinking beyond the immediate products to build longer-term strategic hardware and software integration, especially with the growing demand for AI computing power.

The collaboration is already underway behind the scenes, with engineers from both companies working closely for about a year on the processor designs. This includes deep customizations of Intel’s Xeon processors tailored to Nvidia’s AI platform needs, as well as client and data center product development. Such intensive cooperation means the first joint products are expected only in a few years, likely around late 2027 or early 2028, reflecting the complexity of integrating CPU and GPU architectures into unified chips.

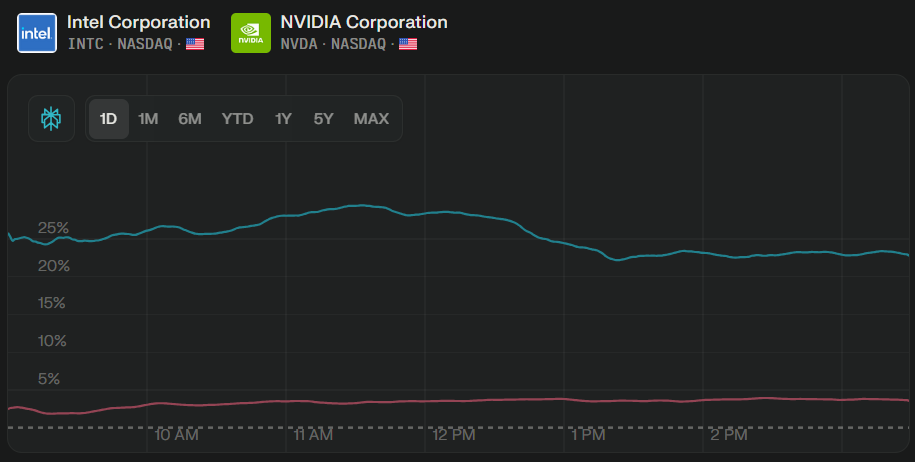

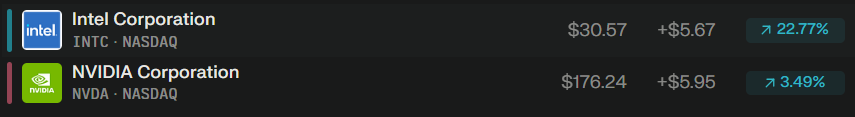

From the market perspective, Nvidia’s investment has had a positive impact. Following news of the deal, Intel’s stock price jumped considerably, showing investor optimism about the company’s future prospects with Nvidia’s backing. Meanwhile, Nvidia itself continues to thrive, posting strong revenue growth fueled by AI and gaming demands, though it also faces challenges such as international export restrictions.

Looking ahead, this partnership could reshape how chips are designed and built for both consumer and data center markets. The move toward combining CPUs and GPUs into integrated SoCs optimized for AI and high-performance computing represents an industry trend. If successful, it could provide both companies a competitive edge, enabling them to deliver more powerful and efficient computing solutions while accelerating innovation in AI infrastructure.

In summary, Nvidia’s $5 billion investment for a 4% stake in Intel and their joint collaboration on PC and data center chips is a strategically significant development. It reflects how major technology firms are aligning to face competitive pressures and evolving demand, particularly from AI applications. The partnership aims to blend Intel’s CPU heritage with Nvidia’s GPU leadership, offering potential benefits for both companies and the wider computing landscape—though the payoff will take time to materialize, with products expected in a few years. This deal captures a moment of cooperation in an industry often marked by rivalry, signaling a potentially new chapter in chip technology innovation.

This outlook is based on recent company statements, market reactions, and industry expert insights as of September 2025. The collaboration will be watched closely as it unfolds in the coming years for its impact on the semiconductor market and technology advancement.

With inputs from agencies

Image Source: Multiple agencies

© Copyright 2025. All Rights Reserved. Powered by Vygr Media.