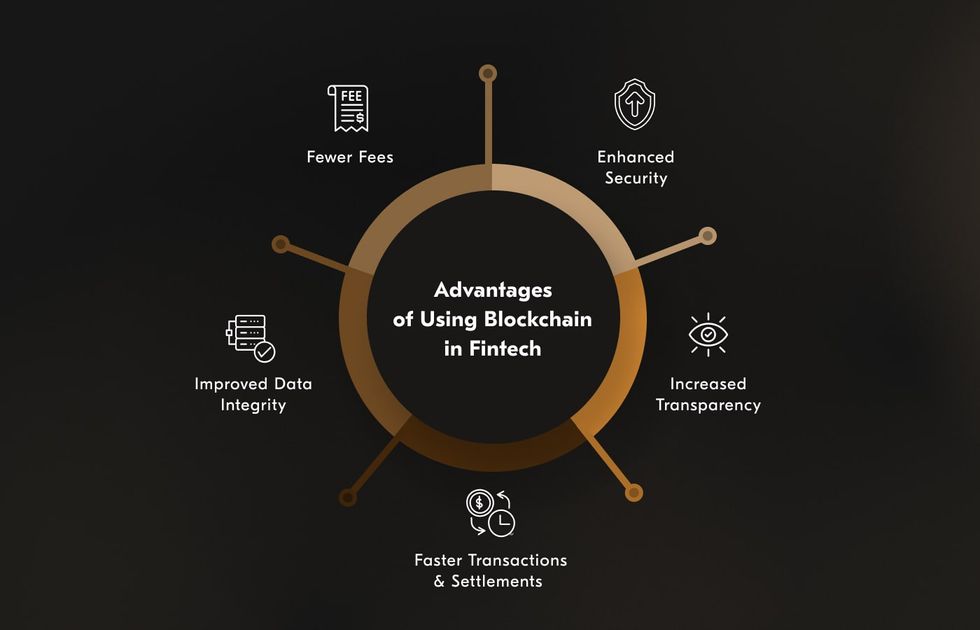

The banking and finance sector is undergoing a seismic shift, driven by rapid technological advancements and evolving customer expectations. Among these innovations, blockchain technology stands out as a transformative force, poised to redefine how financial institutions operate, interact, and deliver value. As we look to the future, the integration of blockchain into banking and finance promises a new era of security, efficiency, transparency, and innovation.

Enhanced Security: A New Standard for Financial Transactions

Security is the bedrock of financial services. Traditional banking systems, despite multiple layers of protection, remain vulnerable to cyberattacks, data breaches, and fraud. Blockchain technology fundamentally changes this paradigm by introducing a decentralized and immutable ledger system. Each transaction is encrypted, time-stamped, and linked to the previous one, making unauthorized alterations virtually impossible.

The decentralized nature of blockchain means that data is not stored in a single location but distributed across a network of computers. This architecture eliminates single points of failure, significantly reducing the risk of hacking and data manipulation. Furthermore, cryptographic algorithms and unique digital signatures for each participant ensure that only authorized parties can access sensitive information, providing an additional layer of security.

Immutability is another cornerstone of blockchain security. Once a transaction is recorded, it cannot be changed or deleted, creating a permanent and tamper-proof audit trail. This feature not only deters fraud but also simplifies regulatory compliance and auditing processes, as all transaction histories are transparent and readily verifiable.

Radical Transparency: Building Trust in Financial Networks

Trust has always been a critical element in banking and finance. Blockchain’s transparent ledger system fosters a new level of trust among participants by making all transactions visible to authorized members of the network. This transparency reduces the likelihood of disputes, enhances accountability, and streamlines auditing.

Every action on the blockchain is recorded and accessible in real-time, enabling stakeholders to verify transactions independently. This single source of truth eliminates discrepancies, reduces the need for reconciliations, and builds confidence among customers, regulators, and business partners.

Transparency also plays a pivotal role in combating financial crimes such as money laundering and fraud. By providing a clear and immutable record of all transactions, blockchain makes it significantly harder for illicit activities to go undetected.

Unmatched Efficiency: Faster, Cheaper, and Smarter Transactions

Traditional banking processes are often bogged down by intermediaries, manual paperwork, and lengthy settlement times. Blockchain technology streamlines these operations by enabling peer-to-peer transactions and automating workflows through smart contracts. This leads to faster, more cost-effective, and error-free transactions.

One of the most significant advantages of blockchain is its ability to eliminate intermediaries. By allowing direct transactions between parties, blockchain reduces settlement times from days to minutes or even seconds, particularly in cross-border payments and trade finance. This not only accelerates the flow of funds but also slashes transaction costs, benefiting both banks and customers.

Smart contracts—self-executing agreements coded on the blockchain—further enhance efficiency by automating routine tasks and enforcing contract terms without human intervention. For example, in trade finance, smart contracts can automatically release payments once goods are delivered and verified, reducing delays and minimizing the risk of disputes.

Cost Reduction: Streamlining Operations and Lowering Barriers

Cost efficiency is a constant pursuit in banking. Blockchain technology delivers substantial savings by automating processes, reducing paperwork, and minimizing the need for third-party verification. The removal of intermediaries not only speeds up transactions but also reduces associated fees, making financial services more affordable and accessible.

Operational overheads are further reduced as blockchain minimizes manual errors, reconciliations, and administrative burdens. Banks can reallocate resources to more strategic initiatives, driving innovation and growth.

For financial institutions, these cost savings translate into improved profitability and the ability to offer more competitive products and services. For consumers and businesses, lower fees and faster services enhance the overall customer experience.

Improved Regulatory Compliance and Auditability

Regulatory compliance is a major challenge for banks and financial institutions, often requiring extensive documentation and reporting. Blockchain’s transparent and immutable ledger simplifies compliance by providing a clear, auditable record of all transactions.

Real-time traceability enables banks to respond promptly to regulatory inquiries and demonstrate adherence to industry standards. Automated reporting and auditing processes reduce the risk of human error and ensure that all activities are accurately documented.

Blockchain also supports granular data privacy controls, allowing institutions to share information selectively with regulators while maintaining confidentiality for sensitive data. This balance between transparency and privacy is crucial in meeting regulatory requirements without compromising customer trust.

Financial Inclusion: Expanding Access to Banking Services

One of the most promising aspects of blockchain technology is its potential to promote financial inclusion. Traditional banking systems often exclude individuals and businesses in underserved or remote areas due to high costs, lack of infrastructure, or stringent requirements.

Blockchain-based solutions, such as decentralized finance (DeFi) platforms and peer-to-peer lending, lower the barriers to entry and enable broader access to financial services. By leveraging digital identities and smart contracts, blockchain can facilitate secure and efficient onboarding, credit assessment, and loan disbursement for the unbanked and underbanked populations.

This democratization of finance not only empowers individuals but also stimulates economic growth by enabling more people to participate in the formal financial system.

Innovation and New Business Models

Blockchain is a catalyst for innovation in banking and finance. It enables the creation of new products and services, such as asset tokenization, decentralized exchanges, and programmable money. Asset tokenization allows for the fractional ownership of real estate, stocks, or other assets, increasing liquidity and opening up investment opportunities to a wider audience.

Decentralized finance (DeFi) platforms, built on blockchain, offer alternatives to traditional banking services, including lending, borrowing, and trading, without the need for centralized intermediaries. These innovations not only enhance customer choice but also drive competition and efficiency in the financial sector.

Banks are also exploring the use of blockchain for secure digital identity management, cross-border remittances, and real-time settlement of securities, further expanding the scope and impact of the technology.

Resilience and Reliability: A Stronger Financial Ecosystem

The distributed architecture of blockchain enhances the resilience and reliability of financial systems. By storing data across multiple nodes, blockchain networks are less susceptible to outages, data loss, or cyberattacks. This redundancy ensures continuous operation and data integrity, even in the event of hardware failures or malicious attacks.

Blockchain’s consensus mechanisms also prevent double-spending and ensure that all transactions are validated and agreed upon by the network, reducing the risk of errors and inconsistencies. This robustness is particularly valuable in critical financial infrastructures, where reliability and uptime are paramount.

Real-World Applications: Transforming Banking Today

Major banks and financial institutions are already leveraging blockchain to transform their operations. For example, HSBC has implemented a blockchain-based trade finance platform to digitize and streamline international trade transactions, reducing paperwork and enhancing transparency. Other banks are using blockchain for secure digital asset custody, cross-border payments, and real-time settlement of securities.

These real-world applications demonstrate the tangible benefits of blockchain in improving efficiency, security, and customer experience. As the technology matures, its adoption is expected to accelerate, driving further innovation and transformation across the industry.

Overcoming Challenges: The Road Ahead

While the advantages of blockchain are compelling, widespread adoption in banking and finance is not without challenges. Issues such as scalability, interoperability, regulatory uncertainty, and the need for industry-wide standards must be addressed to realize the full potential of blockchain.

However, ongoing advancements in blockchain protocols, collaborative industry initiatives, and supportive regulatory frameworks are paving the way for broader adoption. As banks and financial institutions continue to experiment and innovate, the future of banking is set to become more transparent, efficient, and inclusive.

Embracing the Blockchain Revolution

Blockchain technology is reshaping the future of banking and finance, offering unparalleled advantages in security, transparency, efficiency, and innovation. By eliminating intermediaries, automating processes, and providing a tamper-proof record of transactions, blockchain is setting new standards for trust and reliability in financial services.

The journey towards a blockchain-powered financial ecosystem is well underway, with leading institutions already reaping the benefits. As adoption accelerates, banks and financial institutions that embrace blockchain will be better positioned to thrive in an increasingly digital and interconnected world.

The future of banking is not just digital—it is decentralized, transparent, and secure. Blockchain technology is the catalyst driving this transformation, unlocking new possibilities for banks, businesses, and consumers alike.

With inputs from agencies

Image Source: Multiple agencies

© Copyright 2025. All Rights Reserved Powered by Vygr Media.