Gold has held an unparalleled position in Indian households—not just as a precious metal but as a trusted investment. From religious ceremonies to weddings, gold plays a dual role of cultural importance and financial security. With its high liquidity and inflation-hedging ability, gold continues to be a preferred investment choice for Indian investors. Whether you’re exploring traditional gold investments or modern digital avenues, understanding how to invest in gold effectively is key.

Why Gold Remains a Trusted Investment in India

Gold offers unique benefits that make it a strong contender in any diversified investment portfolio. Some of its top advantages include:

-

Inflation Hedge: Gold has historically delivered returns that match or beat inflation, making it an ideal long-term investment.

-

High Liquidity: Gold can be easily bought or sold in physical or digital form, providing investors quick access to funds.

-

Safe Haven Asset: During economic downturns or geopolitical uncertainty, gold prices tend to remain stable or even rise.

-

Portfolio Diversification: Adding gold to your investment portfolio helps reduce overall risk and improve returns over time.

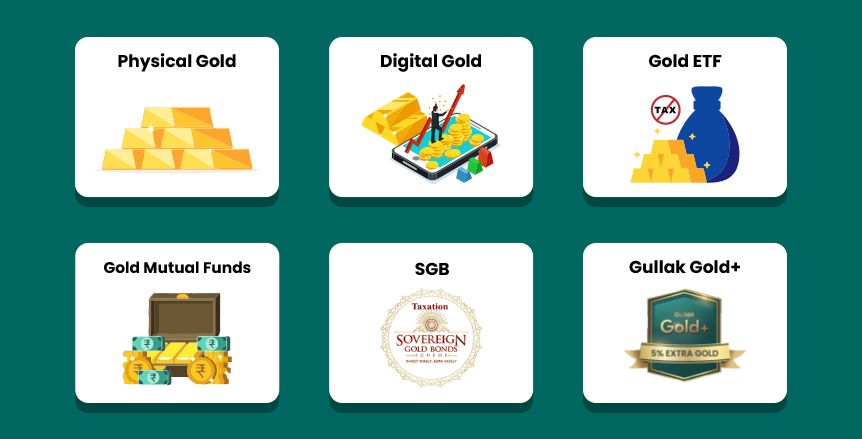

Different Ways to Invest in Gold

Investing in gold today is no longer restricted to buying jewelry or coins. Here's a comprehensive look at the various gold investment options available in India:

1. Physical Gold

-

Forms: Jewellery, gold coins, gold bars, and artifacts.

-

Pros: Tangible asset, culturally significant; no need for a Demat account.

-

Cons: Prone to theft, physical storage issues, making and wastage charges on jewellery.

2. Gold ETFs (Exchange-Traded Funds)

-

Description: Gold ETFs are securities that track the price of physical gold but are held in Demat form.

-

Pros: No storage hassles, high liquidity, and regulated by SEBI.

-

Cons: Requires a Demat account; includes asset management and brokerage fees.

3. Gold Mutual Funds

-

Description: These funds invest in gold bullion or gold ETFs, and sometimes in stocks of gold mining companies.

-

Pros: No need for a Demat account; managed by professional fund managers; SIP options available.

-

Cons: Not directly linked to physical gold prices; subject to the fund manager's decisions.

4. Sovereign Gold Bonds (SGBs)

-

Issued by: Reserve Bank of India (RBI) on behalf of the Government of India.

-

Returns: 2.50% annual interest (paid semi-annually) + appreciation in gold price.

-

Tenure: 8 years with an exit option from the 5th year.

-

Investment Limit: Minimum 1 gram; Maximum 4 kg per individual.

-

Pros: Safe, government-backed; no capital gains tax if held till maturity.

-

Cons: Long lock-in period; less liquidity than ETFs or mutual funds.

5. Digital Gold

-

Offered by: Fintech platforms and mobile wallets.

-

Description: Investors can buy gold online in small quantities, which is stored securely by the provider.

-

Pros: Easy and accessible; minimum investment as low as ₹1.

-

Cons: Limited regulatory oversight compared to ETFs and SGBs.

Comparative Overview: Gold Investment Options

|

Features |

Physical Gold |

Gold ETFs |

Gold Mutual Funds |

Sovereign Gold Bonds |

Digital Gold |

|---|---|---|---|---|---|

|

Demat Required |

❌ |

✅ |

❌ |

❌ |

❌ |

|

Storage Risk |

✅ |

❌ |

❌ |

❌ |

❌ |

|

Liquidity |

Medium |

High |

High |

Low (lock-in) |

High |

|

Returns |

Market-linked |

Market-linked |

Varies |

2.5% + Market-linked |

Market-linked |

|

Minimum Investment |

High |

Medium |

₹100 (SIP) |

1 gram |

₹1 |

|

Tax Benefit |

❌ |

❌ |

❌ |

✅ (on maturity) |

❌ |

Required Documents for Gold Investment

To invest in gold in different formats, here are the documentation requirements:

-

Physical Gold (over ₹2 lakh): PAN Card mandatory.

-

Gold ETFs: Demat and trading account with a brokerage firm.

-

Sovereign Gold Bonds: PAN, Aadhaar, Voter ID, or Passport for KYC compliance.

-

Gold Mutual Funds: PAN and KYC documents; no Demat needed.

Best Gold Mutual Funds in India (2025)

Gold mutual funds offer an excellent opportunity to diversify your investments while avoiding the hassle of physical gold. Here's a detailed look at the top-performing gold mutual funds in India based on 3-year annualized returns (as of February 7, 2025):

|

Fund Name |

3-Year Annualised Return |

AUM (₹ Cr) |

SIP Min |

Expense Ratio |

Risk |

Inception Date |

|---|---|---|---|---|---|---|

|

LIC MF Gold ETF FoF Direct - Growth |

20.51% |

₹71.63 |

₹200 |

0.20% |

High |

Jan 1, 2013 |

|

Aditya Birla Sun Life Gold Fund |

19.85% |

₹428.10 |

₹100 |

0.20% |

High |

Mar 20, 2012 |

|

Axis Gold Direct Plan - Growth |

19.79% |

₹706.42 |

₹100 |

0.17% |

High |

Jan 1, 2013 |

|

SBI Gold Direct Plan - Growth |

19.79% |

₹2,583.37 |

₹500 |

0.10% |

High |

Jan 1, 2013 |

|

Invesco India Gold ETF FoF Direct - Growth |

19.73% |

₹114.20 |

₹500 |

0.10% |

High |

Dec 5, 2011 |

|

HDFC Gold ETF Fund of Fund Direct Plan - Growth |

19.72% |

₹2,765.21 |

₹100 |

0.18% |

High |

Jan 1, 2013 |

|

Quantum Gold Savings Fund Direct - Growth |

19.70% |

₹140.35 |

₹500 |

0.03% |

High |

May 19, 2011 |

|

Nippon India Gold Savings Fund Direct - Growth |

19.52% |

₹2,203.20 |

₹100 |

0.14% |

High |

Jan 1, 2013 |

|

ICICI Pru Regular Gold Savings (FOF) Direct - Growth |

19.46% |

₹1,385.31 |

₹100 |

0.09% |

High |

Oct 1, 2011 |

|

Kotak Gold Fund Direct - Growth |

19.33% |

₹2,291.35 |

₹100 |

0.16% |

High |

Jan 1, 2013 |

Advantages of Investing in Gold Mutual Funds

-

Diversification: Helps spread risk by adding non-correlated assets to your portfolio.

-

Professional Management: Fund managers handle portfolio decisions, ideal for passive investors.

-

SIP Option: Begin investing with as little as ₹100 and enjoy rupee cost averaging.

-

No Physical Risks: Avoid issues like theft or storage of physical gold.

-

Easy Access: Fully digital onboarding and investment process.

Key Limitations to Consider

While gold mutual funds are highly accessible and professionally managed, investors should also be aware of:

-

Price Volatility: Gold prices fluctuate due to global and economic factors, impacting NAV.

-

Indirect Exposure: Some gold mutual funds may not directly track physical gold prices.

-

Management Fees: Though relatively low, expense ratios can reduce net returns over time.

Is Gold a Good Investment in 2025?

Gold remains a compelling investment avenue in 2025, especially amid inflation concerns and global market volatility. Whether you prefer the tangibility of physical gold, the convenience of ETFs, the structured returns of Sovereign Gold Bonds, or the flexibility of mutual funds—there is a gold investment plan for every investor.

For long-term wealth creation, SGBs offer tax-free maturity benefits and guaranteed interest. If liquidity and flexibility are your priorities, then Gold ETFs or mutual funds via SIPs are excellent options. As always, consider your investment goals, risk tolerance, and time horizon before choosing your gold investment vehicle.

Disclaimer: This content is intended for informational and educational purposes only. It does not constitute financial advice or investment recommendations. Please consult a certified financial advisor before making any investment decisions.

With inputs from agencies

Image Source: Multiple agencies

© Copyright 2025. All Rights Reserved Powered by Vygr Media.